From Nation, page 9 - 11, issue no. 361, March 31, 2008

Translated by Liu Peng

Groups of businesspeople from Wenzhou, one of China's cradles for entrepreneurship, will set out for Vietnam, Cambodia and Pakistan to survey industrial park projects there in the coming months.

Depressed by rising manufacturing costs and tighter macro-controls at home, the Wenzhou merchants – who traditionally amassed wealth through trading cheap made-in-China products abroad – are now looking elsewhere for new opportunities. The upcoming "investment assessment" field trip has been organized by the Wenzhou local government in response to the demands of local businesspeople, according to Wenzhou official Ye Yi from the foreign trade and economic cooperation bureau there.

The upcoming "investment assessment" field trip has been organized by the Wenzhou local government in response to the demands of local businesspeople, according to Wenzhou official Ye Yi from the foreign trade and economic cooperation bureau there.

Ye said over 70 enterprises had enrolled for the trip, mainly those from the labor-intensive industries such as shoe-making, leather-production, garment and furniture businesses.

Wenzhou, a provincial city in southern China and populated by roughly seven million people, has one of the highest per-capita earnings in the country. Its merchants have invested heavily in major economic sectors nationwide, and they are widely known for their foresight in Chinese business.

Official data revealed that in the last two years alone, there were 153 Wenzhou enterprises setting up branches abroad. The Wenzhou merchants also established processing plants and industrial parks, exploring energy and resource sectors, and developing real estate in places like Africa and the Middle East.

Trading Made-in-China

"Gone were the days of high profits!" Wu Jianhai sighed when commenting on his recent business performance. Wu is the board chairman of Chinese Merchandise City in Cameroon and also one of the founders of Chinese Chamber of Industry and Commerce in Cameroon.

Wu first entered the Cameroon market in 1994, trading Chinese-made merchandises. Five years later, he established the Chinese Merchandise City in a mall in downtown Duala, the largest city of Cameroon. The mall is specially designated for Chinese merchants and China-made goods. Wu recalled: "At that time, we shipped a container of merchandises from China and we could at least make a two-fold profit."

Time has changed, however, with the profit margins for merchandise like shoes and garments having dropped to around 20%; some other goods registered losses if the timing was off.

Wu blamed the sharp decline in profits to a saturated market, as commercial centers selling Chinese products mushroomed. He added that his relatives who were trading in Spain faced similar predicaments. "The bargaining becomes fiercer and it is harder to raise prices," he said.

Huang Jianwen, Wenzhou Fellow Countrymen Association in South Africa, echoed Hu's explanation, saying cheap Chinese goods had flooded all supermarkets in South Africa. Huang added many of his African partners were deserting Chinese traders and turning to Vietnamese and Thais instead for cheaper goods.

In fact, official statistics showed that Wenzhou's February exports totaled 690 million dollar, a drop of 17.91% when compared to the corresponding period last year. The decline is closely linked to the drooping demand at "Chinese Merchandises Cities" operated by overseas Wenzhou merchants, who since 1998 have set up around 15 such malls in Europe, South America and Africa.

Adapting to Changing Tide

Wu had sensed the imminent decline of Chinese goods trading a few years ago, and he submitted a counter-measure proposal to the Chinese embassy in Cameroon, highlighting the need for Chinese enterprises to establish plants abroad.

In his report, Wu rationalized that light industries were underdeveloped in the Middle East, Africa and South America, thus offering space for Chinese small and medium enterprises with mature technology, skills and equipment to develop there.

"There is little room left for Chinese enterprises to expand at home... if we do not go abroad, we will be killed off," Wu opined.

At present, Wenzhou merchants own at least 100 companies in developing countries, mainly selling light industry products like shoes, leather goods, spare auto, eletrical, and mechanical parts. In the developed countries, Wenzhou companies tend to enter the local market through acquisition or merger with local companies. For example, Wenzhou's Hazan Shoe Company had bought-over Italy's WILSON, a shoe manufacturing company.

In a move to diversify, the Wenzhou capital has also eyed the high-tech and cultural industries. For instance, the CHINT Group is planning to invest 120 million Euros in Spain to build the largest solar-powered station in Europe; while Wenzhou merchant Wang Weisheng has already purchased ALDEER TV, the once state-owned station of United Arab Emirates.

Wu disclosed he was negotiating with African counterparts to develop a 100 hectare industrial park in Africa, adding: "Through such projects, Chinese enterprises may cut imported burdens of taxation, rising labor and land costs. In addition, the project will also solve local employment and taxation problems in Africa."

In fact, some Wenzhou companies have already established industrial parks in Russia, the US and Vietnam. Some succeeded through tendering process organized by the Chinese Ministry of Commerce for overseas joint venture projects, while some invested independently, such as General Protecht Group's 100 million dollar venture in a high-tech park in the US in Atlanta.

After years of being a trader, Huang Jianwen, like many of his fellow clansmen, now focuses most of his resources on real estate and mining in South Africa. His copper mines have been especially lucrative.

Previously, the Wenzhou merchants earned the title of "Coal Trooper" when their capital flooded the mining sector in China. Since then they have become involved in mining markets abroad.

In Zimbabwe, Sino-Africa Energy Cooperation, controlled by Wenzhou businesspeople, has access to a 25,000-hectare chromite mine for 90 years. In Vietnam, Wenzhou businessman Zou Qinghai, chairman of Chamber of Zhejiang Commerce, has sealed an agreement with the Vietnamese government to exploit a chrome mine for 20 years with total investment up to 50 million yuan in three years. On the other hand, Wenzhou Guangshou Group has jointly set up a company with North Korean government to exploit molybdenum mines in the country.

Wenzhou's foreign trade bureau deputy chief Pan Pingping said the local government was building an "overseas investment projects database" to help facilitate some 400 billion yuan worth of private capital to go global. Pan added exploration of resource-based projects abroad was one of the main targets.

Collective Exploration of Overseas Markets

One unique characteristic of Wenzhou private capital is collective financing. Whenever a potentially lucrative business opportunity emerges, fellow Wenzhou businesspeople would gather resources and mobilize funding worth billions of yuan. Sinorich Consortium and Zhongcai Consortium are among the more organized collectives of Wenzhou private capital; however, there are many loosely-linked groups that cooperate when needed.

For instance, Wenzhou Fellow Countrymen Association in South Africa has over a thousand members. Huang said the members would make collective investment when a good project came around. "Usually, these businesspeople know each other well, so it is easier to reach consensus and lend each other the needed capital," Huang added.

During China's top legislative sessions held in March this year, Wenzhou mayor Shao Zhaowei told the press that more than 1.7 million Wenzhou people live or do business throughout the country, with Wenzhou business associations established in 159 cities. He added some 600,000 Wenzhou businesspeople had also set up overseas bases in 93 countries and regions.

As investments abroad increased, the calls for forming Wenzhou-funded Multinational Corporation too gained momentum. Wenzhou's shoe-making Kangnai Group director Wang Jianping presented a proposal themed, "Fostering the Wenzhou Multinational Company" at the top legislative sessions this year, using his own business as an example.

After first opening its overseas specialist shop in Paris back in 2001, Kangnai has since expanded its operation to 300 store fronts in major cities like New York, Milan, Venice, Barcelona, Berlin and beyond. While its Wenzhou counterpart Aokang Group too started opening specialist shops abroad last year, with bases in India, US and Hong Kong. Both groups are aiming to have more than 1,000 shops abroad in the coming five years.

Though government officials acknowledged that Wenzhou companies had progressed well under cross-border operations, they believed the road ahead was still long for these companies to be ready as true multinationals.

Background: Characteristics of Wenzhou Private Capital

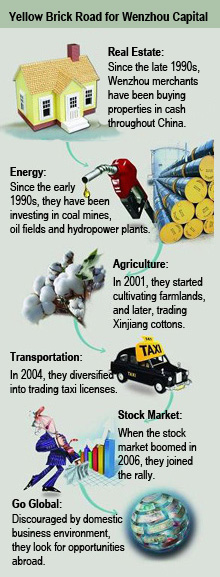

1. Uncertain Investment Targets – Wenzhou businesspeople are known for their sharpness in detecting potential markets, thus they tend to switch quickly from one sector to another depending on investment climate. Their capital has flowed into major sectors of Chinese economy at different phases; including auto-spare parts, garments, optical products, leather-based goods, real estate, coal mines, fuel, and construction materials.

2. Place of Interest – Nearby Shanghai and Hangzhou are among the first places where Wenzhou businesspeople explored. In Shanghai alone, there are 180,000 Wenzhou merchants with around 6,000 companies. Of late, they have moved to Shanxi, Inner Mongolia and Xinjiang to hunt for natural resources.

3. Fund Raising – Wenzhou merchants prefer to raise funding among fellow "clansmen" through collective agreements, shareholding and risk-sharing formulas. Once one returns from a business assessment trip or has invested in a certain project, news would be brought home to raise more funds from family members and friends.

4. Material Investments – Wenzhou merchants prefer investing in tangible assets, such as real estate, mines and even art work. This partly explained why they are late-comers in the stock market and they are not as active in financial investments.

- A Stimulated Diesel Shortage | 2008-04-01

- From China Made to China Consumption | 2008-04-01

- From China's Hills to Silicon Valley | 2008-03-13

- Soya Document Thick With Protectionism | 2008-03-13

- Fierce Contest to Manage CIC Assets | 2008-03-05