Economic Impact of China's VAT Regime Change

By From News, page 3, issue no. 384, Sept 8, 2008

Translated by Ren Yujie

Original article: [Chinese]

Chinese provinces are expected to be impacted differently depending on their industrial underpinnings by a proposed Value-added Tax (VAT) reform scheduled to kick in next January nationwide.

Estimates say the reform would amount to a 150-billion-yuan tax cut for businesses.The EO has obtained several local governments' estimation of revenue losses due to the VAT regime change.

Judging from the data, the relatively industrialized Jiangsu province believed it would experience the biggest losses, while natural resources-rich western region expected to benefit under the reform.

Shenzhen, the first city to open for market economy 30 years ago when China launched its economic reform, expected the VAT regime change to accelerate its efforts in upgrading local industries from labor-intensive to becoming high-technology productions.

The reform, which proposed formula had already been submitted to the State Council for review recently, would involve a shift from a production-based VAT regime to a consumption-based one practiced in most countries.

Under the former VAT regime, companies could not get tax deductions for spending on machinery and capital assets, while the latter system permitted these expenses to be written off.

Industry-based Regions: Worries & Expectations

Jiangsu is a province relying hevily on its manufacturing sector. VAT collections accounted for nearly 70% of its local treasury's tax revenues.

If based on the province's 2002 financial data, machinery and capital asset purchases in eight selected industries in Jiangsu that year amounted to 59.84 billion yuan. If based on the calculation of incremental deduction approach, used in earlier VAT reform pilot programs in China's northeastern region, the amount waived would be 8.69 billion yuan.

If the VAT regime change applied to all industries, as proposed under the new reform formula, the tax deductibles would amout to 15.84 billion yuan, or accounted for 25.85% of the province's overall VAT income.

Assuming that the average annual growth rate of capital asset investments in Jiangsu to be 15.86%, then the VAT regime change would lead to nearly 25 billion yuan of government revenue losses per year on average over the next five years.

Between 2000 and 2006, Jiangsu's overall tax revenues increased by about 20 billion yuan per year on average, and if the above estimation of tax cuts under VAT reform became a reality, local government revenue growth could become stagnant.

Professor Yang Husheng from Nanjing University of Finance and Economics said for places with a high concentration of labour-intensive industries, capital asset investments would be limited, thus less tax deductibles under VAT and would have less impact on government revenues. On the contrary, he added, for places with lots of capital-intensive industries, government revenue losses were expected to be bigger.

Labour-intensive industries generally enjoyed better tax incentives under the existing production-based VAT regime, said Yang. He added these industries were currently hard pressed by weaker global demand resulting from the declining US economy and tighther domestic credit control.

The proposed consumption-based VAT regime would add on to the difficulties facing these industries, Yang said, adding if the industries went under, unemployment would increase, and the government should consider these issues before implementing the VAT regime change.

The above concerns had led Jiangsu officials to suggest that the VAT reform to be applied selectively, and only be implemented in areas loaded with capital-intensive industries.

Shenzhen too is a manufacturing base. However, local government had in recent years pushed hard for low-end and labor-intensive industries to transition into high-technology productions.

Local officials believed the VAT reform had come in time to facilitate such industrial transformation, encouraging enterprises to invest in machinery and technology that could be waived in tax bills, thus accelerating the restructuring of the city's economic sectors.

According to local officials' estimation, after the VAT regime change set in, the highest tax cuts would go to the electronic telecommunication equipment manufacturing sector, bringing about 0.82% drop in government revenue; wholesale and retail sectors would be impacted least, contributing to about a 0.24% drop in government revenue.

Resource-based Economy: Inner Mongolia

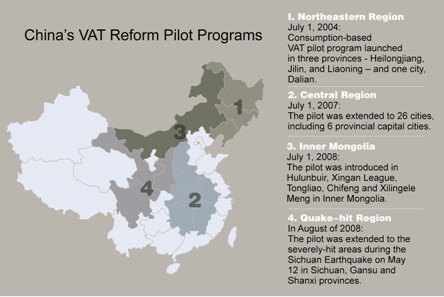

Fives cities in Inner Mongolia were enlisted for VAT reform pilots in July this year. By the provincial tax bureau's estimation, its western region would benefit under consumption-based VAT.

The province's central and western regions have high concentration of metal making, mining, power generation and heavy industries - namely the capital-intensive sectors.

After the VAT regime change, the long delayed double-taxation problem faced by the industries would be solved. That would lead to lower cost of production, and would encourage businesses - especially those in the energy sector - to reinvest in new equipment and technology, thus boosting future output.

Based on local officials' estimation, after the province come under the VAT reform pilot, 664 enterprises would be eligible for VAT deductions. If based on 2005 financial data, tax cuts would amount to 286 million yuan, accounted for 34.28% of the VAT collections that year.

The VAT reform would hurt local treasuries but on the other hand could help to boost local economic development. Some provinces suggested that the central government should introduce a complementary VAT reform package, which would help to compensate local governments' revenue losses due to the VAT regime change.

Among the suggestions included that for the central government to perform fiscal transfer and scheduled subsidies to readjust national tax collections and redistribution.

Experiences from Pilot Programs

Back in the third quarter of 2004, China launched the first pilots VAT regime changes in three provinces and one city in the northeast.

The tax deductibles, however, only applied to eight types of industries - mechinery, petrochemical, metallurgy, automobile, agricultural products processing, power, mining and quarrying, and high-tech.

Prior to the pilot being launched, the three northeastern provinces had estimated revenue losses between 12 billion and 15 billion yuan after the VAT regime change. However, after a year of implementation, local officials realized that the losses were less than expected.

Based on the formula of incremental deduction as per ruling, tax exemptions amouted to 2.76 billion yuan, or about 3.61% of VAT collections for the same period in the three provinces. Even if the local governments allowed deduction in-full, revenue losses would be 4.05 billion yuan, only about one-fifth of the anticipated losses.

By the end of 2006, 9.06-billion-yuan worth of VAT deductions were registered in the pilot areas based on an incremental formula. According to the full deduction approach, the amout would 12.19 billion yuan.

Though the pilot had limited impact on the northeastern region overall economic development, some enterprises viewed the VAT regime change as an investment incentive.

For instance, automobile company Shanghai General Motors invested 143 million yuan in a production line in Shenyang after the VAT pilot was launched. Since August 2004, the plant named Shanghai GM (Shenyang) Norsom Motors had enjoyed tax cuts on capital assets investment totalling 8.15 million yuan.

Another beneficiary was Anshan Iron and Steel Group, which underwent massive technology upgrades and expansion from 2004 to 2005, resulting in huge spending on machinery and fixed assets purchases, and thus enjoyed VAT deductions worth 533 million yuan.

The northeastern pilot revealed that enterprises under different phases of the business cycle were impacted differently. For enterprises that had reached a stabalized mode of operation or those in recession, they would be less likely to make huge investments in machinery or capital assets, thus less impacted by the VAT regime change.

New businesses in the early stages of building facilities, with their investments yet to be translated into products, would not immediately benefit under the tax cuts either. In short, relatively matured businesses under an expansionary mission would benefit the most.

- A 150-billion-yuan VAT Reform | 2008-09-03

- Report Cards Bite Chinese Officials | 2008-08-26

- Green Tax on Big Cars in China | 2008-08-13

- Chinese Migrant Workers in Transition - Part I | 2008-08-04

- Tax Dilemma for China's Ministry of Finance | 2008-07-24