From Corporation, page 25 - 32, issue no. 401, Jan 5, 2009

Translated by Zuo Maohong

Original article: [Chinese]

What does 2009 look like to the corporate leaders in China? What are their greatest concerns and expectations in an economy over which the government still has great influence?

According to a recent survey conducted by the Economic Observer, leading corporate chiefs were mostly pessimistic about the general economic outlook of 2009. However, many of them projected double-digit growth in profits for their own firms in the coming year. The survey was conducted between December 1 and December 29. The EO contacted altogether 118 presidents or board chairmen of China's major companies. Forty-three of them responded.

The survey was conducted between December 1 and December 29. The EO contacted altogether 118 presidents or board chairmen of China's major companies. Forty-three of them responded.

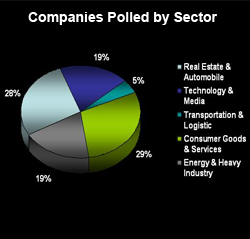

Among the companies surveyed, 19% were amongst the world's 500-strong multinationals and 7% were state-owned companies under the central government. Sorted by sector, 28% were from the heavy industry sector, 19% from the consumer goods and services sector, 19% belonged to the technology sector, and 30% belonged to the automobile and real estate industries.

A Snapshot of the Economy

Forty percent of the corporate chiefs surveyed believed China would have a below-8% economic growth this year, and would encounter mild deflation. Forty-four percent anticipated lower consumer prices, of whom 53% estimated a drop between 1% and 2%.

Data from the National Bureau of Statistics showed China's economic growth fell to 9.9% in the third quarter of 2008, the lowest in recent years. Most company leaders believed this trend would continue into this year.

Against such a backdrop, 30% of the corporate leaders surveyed expected the industry they were in would become less lucrative.

However, many were optimistic about their own profits in 2009. The survey showed 63% of the interviewees believed their profits would keep growing this year, among whom 10% anticipated the growth rate to exceed 30%.

The EO believed such optimism stemmed from stringent control over costs, and increasing market share as the less competent ones were eliminated by a more challenging economic environment. Also of note, all the companies surveyed were among the most important players in their respective sectors.

The survey showed 20% of these companies would freeze the intake of permanent staff in 2009, and another 20% planned to cut staff.

Contractions in investment would be another countermeasure. Of those surveyed, 19% planned to cut investment. For those with plans to invest more, the increment rate would be in the single digits. Over half of those surveyed expected the increase in investment to be below 5%.

Only a few of the corporate leaders interviewed said they had buyout plans. While 17% planned to expand through mergers, most said they would rather grow by way of self-innovation or new product development in 2009. This was contradictory to the judgment of most analysts – investment bankers usually encouraged companies to make purchases in bad times.

New Start, Fresh Hopes

What the corporate leaders wanted most from the Chinese government this year were lower taxes, looser financial controls, and more channels for funding. Their greatest concern was the uncertainty in policies and the government's over-intervention in businesses.

Such concern was shared by all companies in all sectors, including state-owned firms. The survey showed 51% of the respondents worried about unpredictable policies, while 23% feared government intervention.

The survey also revealed dissatisfaction among corporate leaders over China's current taxation system. The country was recognized as having the heaviest tax burden in Asia and ranked third in the world. Counting both direct and indirect taxes, companies based in China would have an average tax burden of over 40%.

Firms surveyed also hoped the Chinese government could reassess its labor policies. Half of the corporate leaders believed the current labor policies should be reviewed, while a fifth declined to comment.

The new Labor Contract Law enforced since January 1, 2008 was widely considered as leaning towards employees' rights. However, many believed so far the Law had resulted in contradictory results.

As for the policy on exchange rates, 66% of the corporate leaders hoped it would remain steady. Half of the remaining hoped for a depreciation of the renminbi within a range of 5%.

As the impact of the global financial crisis was deepening and dragging down China's real economy, the downside of the Chinese currency's appreciation had gradually emerged. Under pressure from shrinking external demand and a stronger renminbi, numerous export-oriented firms had closed down.

Besides hoping for government support for industries, the companies polled also looked forward to the government's increasing spending to improve Chinese livelihoods, thus encouraging stronger domestic consumptions; and also tax rebates.

That said, most of them remained guarded against government action and intervention. Forty percent considered the potential adjustments in industrial and economic policies as their biggest worry.  "[Companies] can adopt a more flexible framework for employment, for example, by employing interim workers. This way human resources can be adjusted according to demand."

"[Companies] can adopt a more flexible framework for employment, for example, by employing interim workers. This way human resources can be adjusted according to demand."

-- Lucille Wu, managing director, Manpower China, an employment service company "Despite the heavy blow from the financial crisis, we expect our throughput to hit 300 million tons and the number of containers to grow to 10 million in 2009. We are confident our total revenue will reach 10 billion yuan."

"Despite the heavy blow from the financial crisis, we expect our throughput to hit 300 million tons and the number of containers to grow to 10 million in 2009. We are confident our total revenue will reach 10 billion yuan."

-- Chang Chuande, board chairman of Qingdao Port Group, which has transport and logistics businesses

"Our growth in 2009 will mainly depend on expansion of the range of products, better efficiency, and merges. As for merges, we will play it by ear. "

-- Xiang Wenbo, executive president of Sany Heavy Industry, an engineering machinery producer

"Though we are still uncertain of the long-term impact of the global financial crisis on the economy, especially the power industry, I believe the influence on China will be limited."

-- Brice Koch, chairman and president of ABB China, a power and automation technology group  "How serious the financial crisis will impact the auto industry mainly depends on the second and third quarters of 2009. Those who can survive this period will have better opportunities."

"How serious the financial crisis will impact the auto industry mainly depends on the second and third quarters of 2009. Those who can survive this period will have better opportunities."

-- Li Shufu, president of Geely, China's first independent automobile manufacturer