News, page 4

EO print edition, issue no. 432, August 17, 2009

Translated by Zhou Yuning

Original Article: [Chinese]  A major shakeup of China's export strategy is taking place. The country is considering altering its focus and may attempt to "create" more external demand by extending loans to trading partners.

A major shakeup of China's export strategy is taking place. The country is considering altering its focus and may attempt to "create" more external demand by extending loans to trading partners.

The Economic Observer learned that the Ministry of Commerce (MOFCOM) had held numerous meetings recently to mull over new means and markets to spur plummeting exports following the global financial crisis.

In view of slower demand from the economically wounded US and EU markets - China's top export destinations - China would now actively explore the full potential of its neighbours and developing countries in Africa, Asia and South America.

The Ministry was even contemplating extending soft loans to developing countries in order to boost their capacity to purchase Chinese exports.

Referring to this strategy as a Chinese "Marshall Plan", former State Administration of Taxation deputy director Xu Shanda argued that by providing funding to help poorer countries to develop and lift their standard of living, the plan would eventually create a market for Chinese goods.

Xu, who is also a national committee member of the Chinese People's Political Consultative Conference, had submitted the proposal to the Ministry for consideration and feasibility assessment.

Creating External Demand

Since joining the World Trade Organization (WTO) in 2001, China's foreign trades grew by over 20% annually for five consecutive years. In 2007, exports accounted for as much as 37.5% of China's gross domestic product (GDP).

However, after the global financial crisis broke, regardless of the various measures taken by the government - raising export tax rebate, loosening credit control, easing fund raising requirements, improving custom clearing etc - Chinese exports slumped.

In the first seven months of this year, China's exports suffered a year-on-year decline of 22%, plunging to 627.1 billion US dollars.

While external demand plummeted, productive capacities continued to grow as China's four-trillion-yuan stimulus package began to take effect.

According to a State Council Development Research Center report - meant for internal circulation only - China's production capacity utilization rate only stood at about 50% to 60%, and many sectors experienced over-capacity in production.

The surplus production needed buyers, yet domestic demand would not surge dramatically in the foreseeable future, thus China must continue to seek buyers abroad.

To address the issue of boosting exports and over-capacity, Xu presented the Chinese "Marshall Plan" proposal to the MOFCOM recently.

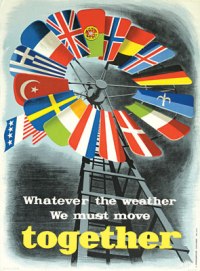

The original term was named after former US secretary of State George Marshall, who initiated a program to aid the rebuilding and recovery of western European countries after the World World II.

Many regions under the program subsequently enjoyed unprecedented growth and prosperity. The program was also credited as one of the fist elements that pushed for European integration and removal of tariff trade barriers on a continental level.  In the Chinese "Marshall Plan" proposed by Xu, he suggested China draw 500 billion US dollars from its huge two-trillion US dollars of foreign reserves, and set up a fund to extend loans to developing countries in Africa, Asia and South America.

In the Chinese "Marshall Plan" proposed by Xu, he suggested China draw 500 billion US dollars from its huge two-trillion US dollars of foreign reserves, and set up a fund to extend loans to developing countries in Africa, Asia and South America.

Xu reasoned that the move would bring about multiple benefits in the long run - apart from ramping up exports, it would also advance the globalization of the yuan, and allow China's domestic demand to grow at its own natural rate without the intervention of fiscal measures.

Challenges Ahead

One MOFCOM official told the EO: "The proportion of export contributions to GDP would not grow endlessly. It may have hit its ceiling in 2007."

He added that even when the US and EU economies recovered, their consumption pattern might be altered by the crisis.

For instance, the saving rate in the US used to be nearly zero, but it had grown to approximately 6% to 7% after the crisis, signaling a more prudent spending attitude among American consumers.

The official said the Chinese Marshall Plan might bring about positive impact in enlarging external demand in new markets.

However, even Xu himself admitted that the proposal is not without flaws.

At present, Chinese law and regulations prohibits withdrawal from the foreign reserves for direct lending to a third country. In addition, banks intending to offer foreign loans must first buy foreign currency from the State Administration of Foreign Exchange.

On one hand, Chinese banks have a rather low loan-verses-deposit ratio, whereby huge sums of yuan-denominated deposits are left "idle"; but on the other hand, this yuan-denominated money is barred from being extended as loans to foreign enterprises under current regulations.

While the Chinese Marshall Plan is still pending further consideration and approval from the MOFCOM, the EO learned that ministry officials had reached a consensus that creating new demand and markets would be a priority in the near future.

One of the first steps to develop new markets would be establishing more economic co-operation zones and free trade agreements with other developing countries, especially those that share borders with China.

Links and Sources

Selling Democracy: Marshall Plan Posters