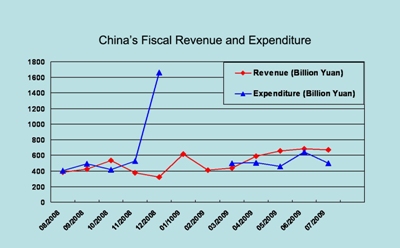

According to a Ministry of Finance report released earlier this month, China collected 669.591 billion yuan in national fiscal revenue in July, up 10.2% on last year's figure for the same month.

The jump in revenue was attributed to a general improvement in the economic environment, rising non-tax income and increased consumption tax from oil products.

However, when we look at the figures from the first half of this year, the national tax revenue decreased by 6% year-on-year, while its annual target for 2009 is to increase revenue by 8.2%.

At the same time fiscal outlays have increased, national fiscal expenditure had risen by 23.5% year-on-year in the first seven months of the year.

Over the past few weeks the Economic Observer has published a series of articles examining recent steps taken by the State Administration of Taxation in order to achieve their goal of collecting an additional 100 billion in taxation before the end of the year.

In this special feature we offer condensed translations of?four recent articles concerned with the tightening of tax collection policies:

Source: Ministry of Finance (expenditure figures for?Jan and Feb 2009 unavailable)? Shake Up of Individual Income Tax Collection

Shake Up of Individual Income Tax Collection

By Wang Biqiang

News, Page 3

EO print edition, issue no. 433, August 24, 2009

Original Article [Chinese]

In order to close loopholes that exist in the current taxation system, the State Administration of Taxation (SAT) is considering revising the Law of Tax Collection and Management.

SAT is attempting to find a better method of collecting individual income tax that will allow them to better identify how much individuals should be paying.

"Individual income tax is the worst regulated area of tax collection in China. The main problem is tax evasion," an unnamed source with close ties to the SAT revealed.

In 2008, the total amount of individual income tax collected in China was 369.7 billion yuan.

According to the current taxation law, individual tax payers have two options when submitting their income tax.

Most individuals pay their taxes via institutions such as the company they work for. This makes it possible for enterprises to pay individual income tax based on the nominal wages of their employees, an amount which is often much less than their real income.

The other option, especially aimed at those who work in the entertainment or service industries, is to submit a tax declaration form based on their earnings for the past financial year.

It's also very easy for people who people their tax in this fashion to under report their income.

As it's impossible for the taxation bureau to chase down individual tax payers one by one, the evasion of individual income tax has caused a great loss for the state.

The SAT hopes, that proposed revisions to the nation's taxation law will bring an end to this dilemma by separating the individual tax payers from their institutional counterparts.  Tax Authority Eyes Property Developers

Tax Authority Eyes Property Developers

By Wang Biqiang

News, Page 4

EO print edition, issue no. 431, August 10, 2009

Original Article [Chinese]

In an attempt to boost revenue, the SAT will intensify its inspection of the real estate industry in the latter half of 2009, sources at the tax administration revealed.

Earlier this month, the tax authority issued a circular calling for all local tax authorities to strengthen tax collection and management in the real estate sector, to ensure the completion of this year's revenue target.

The taxation administration also issued two circulars requiring intensification of such inspections in May.

"As chaotic and complicated as it is, we have decided to make the real estate industry one of our main targets," said an unnamed official within the tax bureau.

As an example of the way that property developers attempt to evade their tax responsibilities, he revealed how a twenty-story development was officially only sold for 50 million yuan, whereas in reality the property was really worth several billion yuan.

One indication of how this push to strengthen tax collection is focusing on the real estate sector, is that, of the 36 major corporations that were earmarked for inspection in early July, eight were property developers, more than from any other individual sector.

In some areas, the internal audits that have been required of property developers have turned up results.

In Hangzhou for example, after the local tax bureau began investigating tax payments among the province's real estate developers, 324 companies were able to locate an additional 221 million yuan in taxes on their books that had not been paid to the municipal authority, this accounted for almost half of the target set for additional tax collection in the city for the first six months of the year.

Collecting value-added tax on land is seen as the focus of the campaign.

The issue of value-added tax has long been a difficult policy issue for tax inspection authorities.

According to the current regulations, developers only pays the VAT on land after a project has been finished. The higher the gross profit, the more tax the developer is required to pay.

But in the past, land developers have attempted to evade the tax by cancelling the registration of their company and other similar moves.

In 2007, the tax authority conducted an inspection of the collection of value-added tax on land, which aside from leading to a slump in housing shares, didn't reach any conclusive breakthroughs.  China Intensifying Tax Inspection in Bid to Boost Revenue

China Intensifying Tax Inspection in Bid to Boost Revenue

By Chen Wenya and Xi Si

News, Page 4

EO print edition, issue no. 431, August 10, 2009

Original Article [Chinese]

China is intensifying its tax inspection in an attempt to increase tax revenue, which declined by six percent year-on-year to 2.95 trillion yuan in the first half of the year.

SAT announced on July 27 that the current inspection aimed at "further strengthening tax supervision, putting a stop to tax leaks, increasing revenue and achieving this year's tax revenue goal."

Earlier this year, the inspection bureau of SAT increased its quota for additional tax collection from 70 billion to 100 billion yuan, almost twice of last year's goal of 51 billion yuan.

Since April this year, the inspection bureau has required major corporations to conduct reviews of their tax declarations during the 2005 to 2008 period.

If there is any extra liabilities are spotted, the corporations are required to pay the taxes as well as any penalty.

If the result of this internal audit do not satisfy the tax authorities, they will spot check several branches of the corporation. Furthermore, if the result is not in line with the report the corporation handed in itself, a comprehensive review will be conducted.

According to some of the corporations that have been required to conduct internal audits, "It's unacceptable for us to not find any additional payments."

According to a source involved in the self examinations, the tax inspection bureau has already more than 20 billion yuan in additional tax.

The first phase of these internal audits were conducted by 24 flagship enterprises across a range of industries that included banking, finance and telecommunications.

The second phase of the project involved 34 major companies including Wanke, State Grid, Dell and China Oil and Food Import and Export Corporation. The second phase is expected to be finished by the end of August.

For the first time in a decade, the inspection bureau has divided the inspection tasks into individual provinces.

A tax inspection official also revealed that if tax revenue continued to decline, it was possible that a third batch of internal audits would be conducted.  Days of Internal Audits

Days of Internal Audits

By Zhang Bin, Wang Biqiang, Wang Baoning

News, Page 4

EO print edition, issue no. 431, August 10, 2009

Original Article [Chinese]

During the past two weeks, Mr Wang has spent all his waking hours with his chief financial officer.

Wang, who is the owner of seven enterprises, explains "I feel there will be a tax inspection crack down soon and not only will it target the big state-owned enterprises, but small companies like mine might also get caught up in it too."

Wang's concerns appeared to be warranted.

A few days after he made the remarkes, SAT released a notice outlining a detailed plan requiring various enterprises to conduct internal-audits.

In April, the first batch of enterprises required to conduct these internal audits included 24 big corporations. Two months later, a second phase of audits were conducted at another 36 enterprises.

"It's impossible for any company to pay the required tax one hundred percent correctly - it's just too complicated. That's why the tax bureaus first force enterprises to complete internal audits. If the targeted firms pay up, nothing serious will happen; but if they haven't met the requirements, the tax bureaus will send people to double check their accounts and recover the tax," said an unnamed source from PricewaterhouseCoopers (PWC).

Two weeks ago, Wang cancelled two of his seven companies.

"After operating for so many years, it's impossible to make the company's accounts correlate exactly with that of the banks. All my questionable accounts are written off through these two companies. This is the only way to avoid inspection.

Wang has also invited registered tax agents and certified public accountants to help with an internal audit of his company.

"The government has set a certain figure as the standard, and those firms with income above this standard will all be strictly audited. This works well, the government knows the signs to look for when checking for evidence of tax evasion," he said.

Although he still adopts lawful measures to reduce his tax burden, he no longer dare engage in deliberate tax evasion.

Correction: We've deleted the translation of the Value-added Tax on Land to be Abolished which first appeared on page 4 of issue no. 433 of the Economic Observer from this special focus. After publication it emerged that?the State Council has no plans to abolish the value-added tax on land during the period of the "Twelfth Five Year Plan", from 2011 to 2015.

Links and Sources

State Administration of Taxation

Ministry of Finance: Report (Chinese)