Highlights from the EO print edition, Issue Wrap No. 486, September 13

Alarm from Wenzhou: Entrepreneurs, Capital Retreating from Manufacturing Sector

Cover

~ Wenzhou City in Zhejiang Province has long been considered the “capital of China’s manufacturing sector”. But now, as the manufacturing sector is facing increasing difficulties, Wenzhou’s entrepreneurs are focusing on investing in properties rather than their own companies.

~ According to a report released by the Wenzhou branch of the People’s Bank of China, with more and more local enterprises moving and capital flowing out of the city, its manufacturing sector is hollowing out. This report was released at the city’s “industrial economic situation analysis conference”, and is viewed as the first time the local government has admitted the existence of a weakened industrial sector.

~ In 2009, Wenzhou’s GDP per capita was only 4,604 US Dollars, ranking it the third to last among all the cities in Zhejiang Province, while simultaneously, the number of “Wenzhou property speculators” has snowballed across the country.

Original article: [Chinese]

Local Governments Troubled by Foreign Debt

News, page 5

~ Though local governments already had tight budgets, they now have huge amounts of foreign debt making things even worse.

~ The World Bank has been cooperating with the Chinese government for 30 years. During the past 30 years, the latter, along with other international financial organizations, has provided over 110 billion yuan of interest-free loans or loans with low interest rates for China.

~ Since 2008, China began to repay those loans whose repayment periods range from 10 years to 40 years. All the loans are invested in specific projects.

~ These loans were guaranteed by both the Ministry of Finance and corresponding provincial finance bureaus. If the sponsors of those projects are unable to repay the loans, the Ministry of Finance will deduct money from the province's fiscal revenue. Then the provincial finance bureau will reduce the payment of the corresponding city-level financial account, placing even more pressure on the already-tight local government budget.

Original article: [Chinese]

Who Will be in Charge of Beijing’s CBD?

Nation, page 9

~Though Beijing’s Central Business District (CBD) is located in Chaoyang District, the new Dongcheng District is trying to have it contained in its new district.

~Another suggestion is to make CBD an independent district.

~Both of the above suggestions have been refused by Chaoyang District because the CBD has become the most important engine of its district-level economy.

~In 2009, the CBD contributed ten billion yuan of fiscal revenue to Chaoyang District, accounting for 60.1% of its total fiscal revenue.

~However, though it is not clear how long Chaoyang District will stick to its plan to keep the CBD in its jurisdiction, it will face more and more pressure as the Beijing government has already planned to separate the functional areas of the city from the administrative districts.

Original article: [Chinese]

New Regulations to Standardise Private Equity Investment Filing Requirments Nationwide

Market, page 17

~ The EO has learned that the National Development and Reform Commission (NDRC) is currently considering new nation-wide regulations that will govern China's PE industry.

~ According to information obtained by the EO, the NDRC is currently reviewing and seeking advice on provisional measures related to "Pilot Areas for Filings by Private Equity Investment Companies"

~ The new rules are going to be trialed in four locations, including Beijing's Zhongguancun, Tianjin's Binhai, Wuhan's Donghu and the Greater Yangtze Delta area.

~ China's PE sector has boomed over the past couple of years, but due to difficulties in getting the existing regulatory bodies to work together, nation-wide regulations have been pushed back many times.

~ The proposed new measures are said to clearly define the filing requirments from PE investment companies

~ After feedback from industry players has been received, it's expected that the new provisional measures will come in to effect before the end of the year.

Original article: [Chinese]

Is Insider Trading not a Crime?

Market, page 21

~ This year the State-owned Assets Supervision and Administration Commission (SASAC) increased its efforts to put a stop to insider trading. However, Gao Yang Cai, general manager of Shaanxi Coal and Chemical Industry Group who has been under investigation for the crime of insider trading for over a year, still delivered a speech at the opening ceremony of a new company project this past August.

~ Last April, the SASAC determined that in March 2007, Gao Yang Cai used his bank account and the accounts of his relatives to purchase and sell Shanxi Construction Machinery Co. Ltd stock right before and right after the public announcement of the stock’s sale; they came away with 165, 000 yuan in profit.

~ The SASAC has handed the investigation into the insider trading over to the Ministry of Public Security, yet for over a year Gao Yang Cai has remained in his position of authority, and has come out unscathed.

~A source with the SASAC has divulged that the SASAC is paying attention to Gao Yang Cai’s case, and are aware that he remains free, but because of the transfer of the case to the Public Security Bureau, it is difficult for the case to progress. The SASAC has been in contact with the Ministry of Public Security, who faults local government for the slow progression of the case.

Original article: [Chinese]

Gome is Falling Down

Corporation, page 26

~ While people across the country are talking about the conflict between Huang Guangyu, founder of Gome, and Chen Xiao, the current board chairman, we’d better pay attention to the company itself.

~ As early as 2008, Gome’s market shares had been surpassed by its competitor: Suning Appliance. The EO has found that currently, Gome’s commodity prices are much more expensive than Suning’s. Additionally, the services provided by Gome employees are unsatisfactory.

~ The above problems are believed to be a result of the conflict between Huang Guangyu and Chen Xiao because while they have been concentrating on their battle for control of Gome, the company’s business performance has fallen.

Original article: [Chinese]

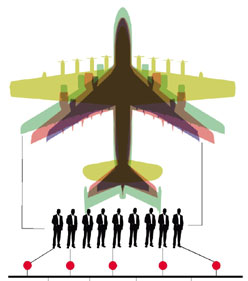

Air Force Pilots Switching to Commercial Aviation, the Real Reason Behind Fraudulent CVs

Corporation, page 27

~In 2008-2009, the Civil Aviation Authority conducted investigation into China’s Major Airline. They found 200 pilots with fraudulent licenses; 103 of the pilots worked for Shenzhen airlines.

~The CAA requires air force pilots to have official military recommendations, known as a “conversion pass,” in order to operate a commercial plane.

~A high-ranking airline official says that instances of fraudulent CVs can be divided into two categories. In the first are newly-hired air force pilots that lack the “conversion pass.” In the second are pilots that knowingly fabricate or exaggerate their flight experience.

~Pilots at commercial airlines can earn up to 10 times the salary of military pilots.

~Retraining a military pilot as a commercial pilot costs 4 million yuan, whereas training a new commercial pilot costs at least 7 million yuan.

~30-50% of pilots at Sichuan, Shenzhen, and Hainan airlines come from the air force.

~ Airline officials insist that the absence of proper recommendations and exaggerated flying experience does not necessarily reflect technical ineptitude.

~CAA says that pilots found falsifying their flying experience will be denied a commercial license and banned from reapplying for three years. They are also considering introducing technical exams for pilots and flight staff.

Original article: [Chinese]