Highlights from the EO print edition, Issue Wrap No. 494, Nov 15

Prices are Out of Control

Cover

~ The price of almost all goods in China, from agricultural products to industrial materials, has surged in recent months.

~ Different reasons have been given for the recent price rises - while the National Development and Reform Commission (NDRC) attributes the inflationary pressures to the "relatively loose monetary policy" adopted by the central bank, the Ministry of Agriculture maintains that price rises are driven by increased producution costs.

~ Though the central government has tried to rein in prices by adopting a series of measures that include: releasing official reserves of sugar, cooking oil and meat on to the market, ensuring a direct supply link between farmers and supermarkets and subsidizing low-income families - severe inflation now appears to be imminent given the second round of quantiative easing announced by the United States.

Original article: [Chinese]

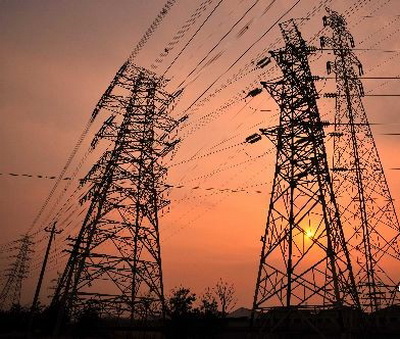

National Power Grid to Cover Tibet in 2012

News, page 3

~ The draft of the 12th Five-Year Plan for China's power sector has been completed. It states Tibet will be connected to the national power grid by 2012, indicating that the whole country will be covered by a unified power network by 2012.

~ Accoring to the draft, the ratios of both the output and equipment installation of coal electricity to the entire power output and equipment installation will be reduced by around 6 percent by the end of 2015 and clean energy will play a larger role than it has before.

~ China plans to raise the ratio of alternative energy (or non-fossil fuel powered) to total energy consumption to 15 percent and reduce carbon emmissions by between 40 to 45 percent by 2020.

Original article: [Chinese]

Transfer of State-owned Shares Brings 30 Billion Yuan to Social Security Fund Every Year

News, page 6

~ China has required all state-owned enterprises (SOEs) listed on the A-share market to transfer a portion of their shares to the national social security fund. As of 2009, a 10 percent stake (as proportion released during the intitial public offering) of all SOE holdings, has to be transferred to the social security fund.

~ Currently, newly listed SOEs along with 75 percent of established stocks have already completed this transferal. The move means that the national security fund will increase its revenue by 30 billion yuan a year.

~ However, as many SOEs rely on the monopolization of industrial resources in order to gain their profits, some argue that all of these companies should also transfer part of their revenue to the national social security fund.

~ Currently, China's social security fund is worth only 700 billion yuan while demand for the fund will amount to at least three trillion yuan over the coming decade.

Original article: [Chinese]

What Disney Means for Shanghai

Nation, page 9

~ The construction of a Disney theme park may be a welcome buffer while Shanghai undergoes economic restructuring.

~ Shanghai has been suffering from an overreliance on large industrial projects; its GDP growth has been falling for the past 2 years. In 2009, Shanghai's GDP growth rate was at a record low of 8.2 percent, lower than the national average.

~ Industry insiders believe that the Disney Project, in conjunction with the 12th Five Year Plan, will benefit Shanghai's future growth prospects.

~ The Shanghai Disneyland Project was officially launched along with the Shanghai International Tourism Resort Zone after the Walt Disney Company and the Shanghai Shendi Group (上海申迪集团) reached an agreement on November 5th.

~ The Disneyland Project is expected to cost 24.48 billion, and the first phase of development and construction is expected to finish in 2014.

~ Some experts say that the Disney theme park will help to increase Shanghai's GDP by 1 percent and also generate 50,000 to 150,000 jobs.

~ The theme park is expected to stimulate every area of the economy from service, to tourism, to entertainment.

~ The project will also help ameliorate the effects of an expected post-expo slump in consumption and investment and help Shanghai transition into a service based, instead of manufacturing based, economy.

~ Disney will likely expand into the Chinese market for online gaming and animation, which may have a positive effect in Shanghai, whose profits in the high-tech sector totaled only 7 billion yuan last year.

Original article: [Chinese]

Postal Savings Bank: Microcredit Makes a Breakthrough in Rural Areas

Market, page 19

~ Rural loans are changing the face of the Chinese countryside.

~ The need for financing in rural areas is growing, but capital is still flowing out of the rural market.

~ Faced with the need for a sustainable business model, the Postal Savings Bank of China turned to microcredit.

~ The Postal Savings Bank offers farmers small loans at an interest rate of 13.5 percent. According to the Postal Savings Bank head of information management Zhu Dapeng, high interest rates allow the bank to provide persistent quality service.

~ Farmers are generally low risk loan applicants, and by hiring local loan officers, the risk is further reduced.

~ The bank has grown rapidly since introducing microcredit in 2008.

~ This year, rural loans grew 24.2 percent, up significantly from the 13.6 percent growth reported last year.

Original article: [Chinese]

The Age of Affordable Luxury - Brand-name Goods are Becoming Cheaper in China

Corporation, page 25

~ Because of the relative weakening of the US dollar to the Chinese yuan, luxury goods, including brand-name products produced by Louis Vuitton, Calvin Klein and Fendi, are now cheaper in mainland China than in Japan and France. Another reason for the price gap is recent efforts by luxury good producers to alter their prices so that they better reflect income levels across the world.

~ Meanwhile, the price of some digital products in China are now lower than those in Japan because most of them are manufactured in China.

~ The reverse pricing trend of luxuries has dealt a heavy blow to the business of small-scale luxury good importers.

~ In addition to domestic price cuts, a new policy introduced by the General Administration of Customs which has reduced the value of goods exempt from import tax from the previous 500 yuan to 50 yuan, has also harmed the bottom line of those who purchase goods abroad for resale in China.

Original article: [Chinese]

Xi'an Needs More than Land

Nation, page 12

~ After many years maintaining economic growth, the growth rate of Xi'an’s secondary industry has fallen to 7.8 percent. Local officials are concerned that land policy is an important factor affecting industrial development.

~ However, Xi'an’s land policy is only one of the causes of the decreased growth rate; the decrease also has to do with local officials’ ideology about what constitutes development and achievement.

~ The local government needs to change their concept of “development” and focus on strategic new industries like aerospace and new energy resources. Then Xi'an's industrial GDP should return to 40 percent.

Original article: [Chinese]

Stock Exchanges have Lost their Way

Market,page 17

~Stock exchanges are confused about how to deal with their earnings, which in the past five years have surpassed 5 billion yuan according to a source familiar with the situation.

~ Aside from operational costs and basic construction costs, stock exchanges have not found a way of returning investment to exchange members because of unclear legal framework and members inability to invest returns according to market principles. Additionally, according to the central government's administrative system, pay cannot be internally redistributed and cannot be transferred to the Ministy of Finance.

~ Income from stock exchanges can normally be spent in two ways:through paying staff salaries and IT system maintenance costs, but the IT systems used in China's exchanges are already very advanced and their staff is already very well paid.

~ China's capital market has gradually matured over the past twenty years; stock exchanges need to mature as well by reforming their membership system and management structure.

Original article: [Chinese]