News, Cover, Issue 498, December 13

Translated by Tang Xiangyang

Original article: [Chinese]

The Chinese government will significantly reduce the tax burdens of individuals and companies in the upcoming 12th Five-Year Plan.

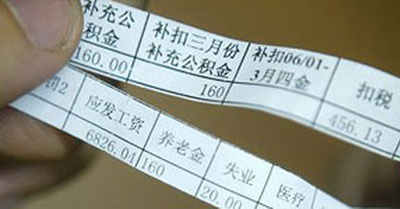

The personal income tax reform project will be issued as early as the beginning of next year. The reform will not raise the tax floor as previously expected, but will reduce number of income tax levels to six or seven.

Additionally, sales tax will be eliminated and the value added tax rate will be reduced. The State Administration of Taxation has drafted a plan to redesign and reform the entire tax system, meaning that China will undertake its biggest tax reform since 1994.

Although it is difficult to determine the total value of the tax cut, an anonymous local government tax official has told us that the scale of the tax cut would be much larger than the reductions made during the financial crisis.

In 2008, when the financial crisis broke out, the Chinese government reduced taxes by 500 billion yuan.

The central government has been monitoring the drafting of the tax reform section of the 12th Five-Year Plan since last year. Though local governments still disagree over the details of the policy, the two levels of government have shared priorities: reducing the personal income tax paid by individuals with medium and low-level income, eliminating the duplicate collection of value-added tax and sales tax and removing tax policies that impede industrial development.

As originally planned, there were proposals for short, medium, and long-term reform projects for personal income tax. Although the Ministry of Finance and the State Administration of Taxation had wanted to issue a comprehensive tax system, they ran into legal obstacles and problems with information gathering and coordination among ministries. The two ministries then chose to issue a short-term reform plans.

Additionally, the tax threshold for labor incomes and from wealth and asset transactions will be raised on par with the threshold for working incomes. Currently, the threshold of the former is still 800 yuan. "Working income and income from wealth transactions applies to white collar jobs. The policy will lessen the tax burden on the middle class," an anonymous expert said.

"We didn't expect the readjustment of tax levels and gaps between levels; we had been focused on raising thresholds. But raising thresholds has no obvious effect except in reducing the taxed population. By readjusting tax levels and gaps between levels, the tax burden of workers might be reduced by dozens of billion yuan," said an anonymous source serving a local financial bureau.

Meanwhile, the Ministry of Finance and the State Administration of Taxation are accelerating the drafting of the mid to long-term target of the reform project: the establishing of a comprehensive personal income tax system. "The tax department will set a 'dependents index' that will adjust tax rates to reflect the number of dependents in each household," one insider said.

"It's difficult to realize this target because it requires tax payers to report their income and the tax administration to process the marital and banking information of every individual. We are not optimistic about carrying it to fruition during the 12th Five-Year Plan period."

Tax on the Wealthy Still Undetermined

The central government has also required the State Administration of Taxation to adjust taxes imposed on people with high incomes; the adjustment remains unset because officials disagree over how best to tax the China's wealthy.

Adjusting taxes on the rich means raising their tax ratio, however, the current tax ratio of 45 percent is already one of the highest in the world. Further increases will likely encourage tax evasion.

A local tax official suggested reducing the highest income tax ratio to 30 percent; this will lower the incentive for evasion through asset transfer and ultimately increase tax revenue.

Currently, a number of wealthy Chinese avoid paying the high personal income tax by transferring their assets to Hong Kong and Singapore. The Shanghai government has set the tax ratio for high level executives in the financial sector at 25 percent to encourage them to pay taxes to the local government.

The Tax Burden on Companies will be Reduced

The tax burden on companies will also be reduced. The value added tax will replace sales tax; it will cover the commercial sector and the service industry. The sales tax will be eliminated.

Currently the sales tax is levied on total business revenue rather than the added value. For example, companies in the service industry cannot have the amount of sales revenue on which they have paid value-added tax deducted before paying the sales tax.

Financial insurance companies have urged the central government to reduce the sales tax ratio on their respective sectors. In the latest report, they hope the ratio will be reduced to less than 3 percent.

In 2009, the central government shifted the value added tax from a production-oriented tax to a consumption-oriented tax, deducting money used to buy equipment. This policy saved companies 170 billion yuan in taxes.

Sales tax currently covers the service industry, immovable properties and immaterial assets. After the value added tax replaces the sales tax, factory buildings, workshops and other immovable property will be deducted from the tax base. It will also help eliminate duplicate taxation.

"Although we do not know how much the tax cuts will total, we are sure that the whole service sector, including financing, trust, insurance, logistics and transportation, will benefit from it," Yang Zhiyong, director of the Chinese Academy of Social Science's financial politics research institute, said.

Additionally, the ratio of value added tax will also be reduced.

Except for energy-intensive, high-pollution, or resource-oriented companies and companies labeled as "restricted enterprises by the government, all companies will be covered by the new tax policy. "If the policy takes effect, my factory buildings as well as my research expenditures will be deducted before paying the value added tax. That will save me lots of money," the owner of a textile factory located in Jiangsu said.

The government is in the process determining whether cosmetics and jewelry should be excluded from the consumption tax. "As people's living standards are lifted, cosmetics are no longer luxuries. To tax them will only promote cosmetics sales in Japan and France," a local tax official said. Jewelry fits into the same category.

Pressure and Motives for Tax Cuts

"The current tax rate is very high. We have to cut taxes," said two local tax officials interviewed by the EO.

"We do not have enough pre-tax deductions. Even subsidies for business trips and vehicles will be taxed. The current tax does not take family expenditures into consideration, and the tax ratio is high," a local tax official said. The first level of personal income tax is 2,000 yuan per month, an income level which does not even cover basic expenses in some cities. Suppose a white-collar worker earns a salary of 7,000 yuan per month, pays a housing mortgage of 2,000 yuan and a personal income tax of 625 yuan, leaving only 4,375 yuan for education, healthcare, daily commodities, and other expenses. "It's impossible for him to save any money if he lives in a city," said a media worker surnamed Huang.

The State Administration of Taxation estimates that taxes paid by ordinary workers account for two-thirds of the entire amount of personal income tax, and is pushing for lowering the tax burden of ordinary workers and people with medium to low income levels.

The heavy tax burden for companies has impeded their innovation and development. The duplicate sales taxes, excessively high ratio of value added tax, and other similar taxes have placed great burdens on companies.

The above owner of a textile factory in Jiangsu province said that after paying various taxes and making deposits into employees' social security funds, the company reported next to no profits.

However, experts and officials interviewed unanimously believe that tax cuts will not reduce China's tax income. Tax revenue from energy-intensive, highly polluting or resource-oriented enterprises as well as individuals with high income will increase. Additionally, issuing a property tax, environmental tax and the lifted resource tax will bring more revenue to the government.

Yang Zhiyong said the tax ratio of the pending property tax must be moderate otherwise it would swallow all the benefits brought about by the tax cuts.

This article was edited by Ruoji Tang and Rose Scobie