By Song Fuli (宋馥李)

Nation, page 10,

Issue No. 536, Sept 12, 2011

Translated by Zhu Na

Original article: [Chinese]

Private Financiers

“Let’s talk about it tomorrow, I am in a hurry now to distribute interest to my clients,” said Xue Mei as she hung up the phone.

Sept. 9 was an extremely busy day for Xue. She got up early in the morning and went to the bank to withdraw several thousand yuan, and accompanied by a cousin, drove to the houses of a few friends and relatives who lent money to her. In fact, the 9th day of each month is always busy for her because she pays interest in cash to a few relatives and friends.

Xue hasn’t been working for two years, she felt that a fixed-hour job makes little money and lacks flexibility. “I don’t want to make a fortune; I am okay with just having enough money to spend,” said Xue. She is engaged with private financing and lending.

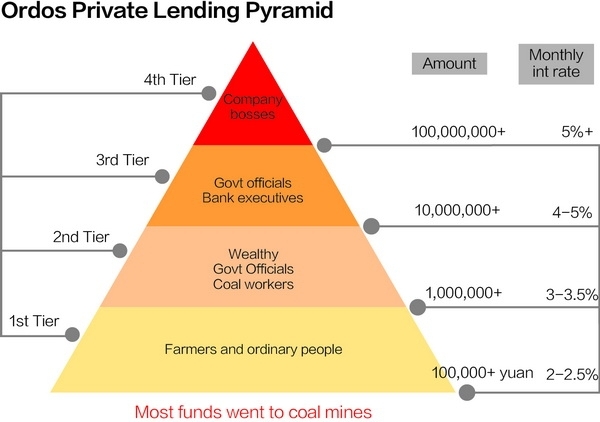

She started to be involved with financing three years ago. The first person to give her a loan, totaling 500,000 yuan, was one of her cousins who trusted her. This was the largest amount of loan she handled at that time, usually the financing ranges from 100,000 to 300,000 yuan, with a 2% monthly interest rate. After that, she persuaded her husband’s friend, her classmate’s brother and her uncle’s nephew to pass her money for her to lend out. The people who she gets money from are actually limited to the social contacts of her and her husband.

Xue will lend these funds to a higher level of financier who typically handles large sums of money from tens of millions of yuan to hundreds of millions of yuan.

Xue will always check the background of her higher level of financier and said, “They must have a good reputation and be rich, only these people can be a financier.”

Xue’s higher level of financiers with several tens of millions yuan are mostly relatives of, or owners of, well-known local enterprises, such as pawn or investment companies.

Within one year, Xue’s financing base reached more than 2 million yuan with mostly 2% monthly interest rate paid to those who lent her money. While the bank’s monthly interest rate was just 0.3% to 0.4% at that time. One million generates about 20,000 yuan each month, so a year is 240,000 yuan. If these were deposited in the bank, there wouldn’t be much interest. Every month, Xue pays over 40,000 yuan in interest to the people who provide her funds.

Xue divides her 2 million yuan into 3 different amounts to lend out separately to the higher level of financiers, and gets a return of 2.5% or 3% monthly. One loan was lent to her ex-colleague whose husband is an official working at Ordos political-legal department, the other was lent to her husband’s cousin who runs two hotels, and the last part was lent out to the wife of a local bank executive.

This kind of private lending uses very simple I.O.U.s, stating only the amount owed, the monthly interest rate and the date of payment. The most important thing is to have the fingerprints of the borrower and lender in the I.O.U.

Most local large scale enterprises are involved with the small loans business. There are 84 small loan lending companies in Ordos, the total registered capital is up to 13 billion yuan, according to Zhao Guangrong, vice director of Ordos financial services office.

Positive and Negative Sides of Private Lending

In Ordos, there are many people like Xue who finance funds and lend them out. It was estimated there are more than 2,000 such private financiers. They’re the ones who collect idle cash at all levels to form a huge underground financial market.

However, Xue doesn’t know where these funds end up. As a middle-level financier, her main function is to pay monthly interest to people who lent her money, and receive interest from her higher level financier to whom she lent those funds, and then make money out from the spread. Under normal circumstances, financers handle more funds with higher monthly interest rate, meaning they will bear greater risk.

“More funds mean greater responsibilities,” said Xue, being very satisfied with her current status. There is no problem for her keeping a stable income of hundreds of thousands of yuan a year. Although, there are many opportunities for her to expand the size of the financing, she gave them up.

“People who made a fortune through this way are very daring,” said Xue. The higher-level financiers handle funds of hundreds of millions of yuan, and the risk they bear is much greater. By this point, the monthly interest rate often reaches up to 5% or more. But surprisingly, this level of financiers is normally young people in their 20’s. Xue had only heard about them and has never met them.

High interest rates are involved with industries with exorbitant profits that can support the borrowing costs. In the past few years, it was Ordos’s coal and real estate industry supporting the continued prosperity of private lending with high interest rates.

The fast urban expansion of Ordos made farmers and herdsmen become instant millionaires through land acquisition and compensation. These rich farmers and herdsmen invested in real estate industry or illegal underground banking (地下钱庄) instead of purchasing cars, which caused the property investment and private lending with unprecedented active.

How many underground financial funds are flowing in Ordos? Nobody knows. But the enormous private funds played a role in the process in the economic development or Ordos, which can’t be overlooked. Market sources estimated conservatively that the private lending funds exceed 300 billion yuan, and most of those loans are made on the grey market at extremely high interest rates.

Encouraging Hands from the Government

Coal prices have been skyrocketing for several years, which makes the coal industry a way to earn large amounts of money quickly in Ordos. The city’s many coal groups have absorbed large private lending funds. Coal mines favor underground finance since it’s simple, flexible, and fast – the opposite of banks. A person who is familiar with the issue said that borrowing half a million yuan from the bank takes more than half a year, and might fall through, while it only takes three days to borrow money from regular small loan lending companies as long as a business operating certificate and pledges are provided.

Private lending can be done at “rocket speed” - long-term stable clients generally only need an I.O.U, then tens of millions of yuan can reach the client’s account that day. Coal enterprises normally need short-term funds for one to three months. Although, private loans’ interest rates are very high, often only they can meet urgent needs.

Capital turnover relying on underground funds is obviously not a long-term and stable policy. Zhao from Ordos financial services office said that, “to gradually regulate enterprises’ financing behavior, we must guide them to IPO.”

However, owners of coalmines in Ordos are not interested in stock market listings that would require standardized and transparent finances. Most of them are accustomed to just making a phone call to friends when they need funds. Zhao once tried to persuade the owner of a powerful coal power company, who replied, “I have enough money to spend. Why do I need to get listed, and let other people get involved?”

Ordos Private Capital Investment Service Center initiated the establishment of a small-loan lending company and guarantee corporation, which is applying for the approval of national authorities. It is expected to be approved in September. Tian Yongpin who is a leading person for the Center said, “We hope this small-loan lending company will become a platform that is jointly shared by the government, and through this platform can reduce capital risk.”

“In this platform, interest rates can be decided by the market, which can induce private funds to emerge,” said Tian.

Currently, the small-loan lending company is trying to attract idle cash from private and local small and medium-sized enterprises.

As the only major financial reform pilot region in Inner Mongolia, Ordos also encourages the establishment of private equity funds. Currently seven equity investment institutions have entered the city.

Li Guojian, Deputy Mayor of Ordos City said that this is not an expedient measure to solve the problem, but rather a way to nurture the industry. Private funds collected in the form of equity investments, such as private equity and venture capital, will be invested in industries locally and across the country.