Issue No. 542

Oct 31, 2011

News, Page 4

Original article: [Chinese]

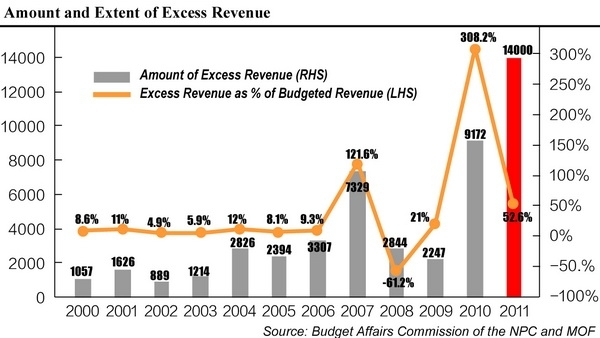

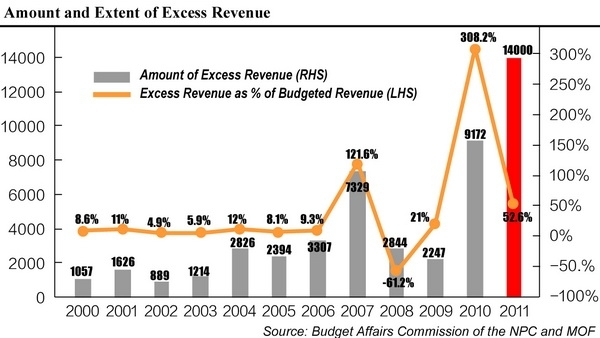

Every year since the tax-sharing reform of 1994, governments have collected more taxes than forecast, and the size of this excess has been growing since 2000.

In the five years up to 2005, the excesses totaled one trillion yuan; in 2007 alone they totaled 720 billion yuan and the excess persisted even during the global economic downturn, before growing to a record 900 billion yuan in 2010.

This year, the government had forecast total revenue of 9 trillion yuan, but it had already collected

9.7 trillion yuan by the end of November.

When asked to explain these excesses, officials cite faster-than-expected growth and one-off lump sums. For example, in 2007, the Ministry of Finance cited the sale of state-owned assets by government railway operators.

Over the last two years, revenue has grown by 20 percent annually, more than twice the forecast of 8 percent. Academics say that China's forecasting errors are far larger than other countries.

The country has carefully-considered procedures for when government revenues fall short of forecast, but there are few instructions for what they should do with excesses.

Rewards for Conservatism

The inaccuracy of forecasts is so common that it's unlikely the underestimates are accidental – they're more likely to be a result of the incentives for officials who collect excess revenue.

For example, in 2009 the Shanxi city of Datong (大同), said it would reward taxation bureaus with 5 million yuan if they met collection targets. Employees at these bureaus were also rewarded for exceeding targets, with up to 25,000 yuan on offer to those who beat their targets by 6 percent or more. Beijing and Jiangsu enacted similar policies.

The attitude of the government towards excess revenue has changed from passive acceptance into encouragement, says Gao Peiyong (高培勇), an economist from the Chinese Academy of Social Sciences (CASS).

China's Budget Law requires that budget revenues should be "in line" with growth in gross national product. Unlike some American states where changes in tax revenue to be to be pegged to changes in income, China doesn't have any specific guidelines in place.

Budgeting for Excesses

When governments collect more than expected they also spend more than expected, and before 2007, most of the excess was spent in the same year, but their extra expenditure of 700 billion yuan in 2007 attracted a lot of attention from the NPC and the media.

By law, unless they receive a special request from the NPC, the governments aren't required to get approval for the way they spend their excess funds, they just need to report their decisions to the congress afterwards.

After the huge excesses of 2007, the central government established a special fund to pool the excess revenue and roll it over into revenue that could be spent over future years. But only 100 billion yuan of the excess 700 billion yuan went into the fund. Similarly, in 2010, only a small fraction of the excess was pooled for future years.

More importantly, since governments weren't formally anticipating the extra funds, their budgets did not contain arrangements for the additional revenue should be spent. On the other hand, the excess revenue has become a necessity for some local governments.

"If there wasn't any excess revenue, then our local financial situation would be extremely difficult," said one finance official from Qinghai Province.

Some provinces and cities in western regions, including Qinghai, said that their budgets at the beginning of the year were actually in deficit.

"We are not able to balance [the budget] although we reviewed the essential expenditures several times. But we can make ends meet by enhancing tax collection throughout the year," said the official.

A Free Hand

The central Ministry of Finance in Beijing has a special fund that manages the allocation of any excess revenue, but local governments are free to spend the funds as they see fit. This meant that only half of the central government's excess revenue in 2010 was spent that year, whereas almost all of the excess revenue collected by local governments was spent in the same year.

Recently, regulatory changes have been proposed that would require local governments to hold off spending any excess revenue until the following year. However, the proposals haven't yet been approved and it's not clear when there will be a solution.