Highlights from the EO print edition, issue no. 434, August 31, 2009

State Council to Get Tough on Excess Capacity

News, cover

~ China's State Council has decided to once again turn its attention to reigning in the problem of excessive capacity that has become more prevalent in some industries since the launch of the 4-trillion yuan stimulus package.

~ A recent NPC report listed 19 sectors where excess capacity exists, these include iron and steel, textiles, electrolytic aluminium, cement, shipbuilding, solar and wind power.

~ Officials plan to slowly reduce productive capacity in these sectors by limiting industry access, strengthening environmental assessment procedures and also by providing enterprises, especially those with outdated industrial facilities, with viable opportunities to exit the market.

Original article: [Chinese]

Over Capacity Troubles Solar Industry

Corporation, page 25

~ China currently plans to raise the amount of power it produces from solar energy to 300 MW in 2010 and to 1800 MW by 2020. But EO has learned the production capacity of the projects already under construction is already 13 times that of the 2010 target and more than double that of 2020.

~ To win a favorable position in the future photovoltaic market, Chinese state-run energy companies are striving to get their hands on large areas of land with plentiful sunshine. The land use rights are often transferred for free as local governments are eager to attract investment and the associated job opportunities.

~ However, as the on-grid price of solar power is yet to be settled, there is uncertainty about the profitability of any projects and enterprises are choosing to wait and see.

~ This inactive land along with the prospect of excess capacity has aroused the government's concern and there are plans to regulate the development of the photovoltaic industry.

Original Article: [Chinese]

What's Pushing Up the Price of Food?

News, page 4

~ From June to August, the price of pork at a large wholesale market in the Beijing suburbs has increased from 10 yuan/kg to 16 yuan/kg. The price of rice, eggs, edible oil and other agricultural products has also risen.

~ The National Development and Reform Commission (NDRC) has attributed these recent price rises to expectations of rising inflation brought on by the huge growth in credit and the emerging bubbles in the property and stock market.

~ Though others claim that the moderate price increases are just signs of both a broader recovery and seasonal fluctuations.

~ In an attempt to keep prices stable, the NDRC has introduced price ceilings on certain items, in a repeat of measures adopted to control mild inflationary pressure in 2008.

Original Article: [Chinese]

Who's Benefiting from Export Tax Rebates

News, page 5

~ The ministry of commerce states that the goal of the export tax rebates policy is to maintain export markets and jobs and not to increase profits.

~ In the first half of the year, China's textile exports experienced negative growth in all markets, though the pace of decline has now slowed in all areas aside from Oceania and Latin America. In addition, over the same period, Chinese textiles have been able to slightly increase their market share in the Japanese, American and European markets.

~ Some exporters believe that foreign firms are gaining from from the policy.

~ Other exporters argue that without it, they wouldn't be able to compete.

Original Article: [Chinese]

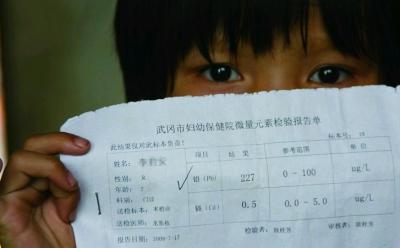

Environmental Pollution and Health: Lead Poisoning

Nation, page 9 and 10

~ This week's EO features a special report on the recent cases of lead poisoning caused by industrial pollution in Shaanxi and Hunan provinces.

~ In Fengxiang County in Shaanxi Province, lead levels in over 800 children exceed the standard and 100 children are suffering from lead poisoning.

~ Over one thousand people, including many children, have been diagnosed with lead poisoning in Hunan's Wugang.

~The sickness is believed to be caused by pollution from local factories.

~ Over the following weeks, EO plans to publish a series of reports on the health risks posed by environment pollution in the process of developing heavy chemical industry across the country.

Original Articles: [Chinese] and [Chinese]

Central Bank Takes Monetary Policy Middle Path

News, page 2

~ In the People's Bank of China annual report for 2008 released on August 25, the goal for M2 growth in 2009 is set at 17%

~ Given that in the first 7 months of the year, M2 has already increased by 28.5%, some are interpreting this as a sign that monetary tightening, despite all the announcements to the contrary, will indeed take place in the second half

~ Most analysts believe that the central bank will pursue a "middle way" monetary policy that aims to maintain stability and that they won't make any sudden moves to tighten money supply, but alternatively, with an eye to the long term goals and expectation of inflation, they'll gradually use various methods to put the brakes on the growth of the money supply

Original Article: [Chinese]

Firms Seek Official Explanation of New Tax Rules

News, page 3

~ Foreign-funded equipment leasing firms have been plagued by problems associated with the introduction of the value-added tax regulations, which came into effect on January 1 this year.

~ The revised regulations no longer allow companies to deduct spending on machine rentals from their tax bills. However, if companies purchase machinery or capital assets, they're allowed to deduct all such spending from their tax bill.

~ State-owned machine rental companies are able to find means of getting around the new regulations, but these methods are not available to the firms with foreign investment.

~ With that in mind, scores of foreign-funded equipment leasers are considering jointly petitioning the government to explain the rules more clearly.

Original Article: [Chinese]

Central Enterprises Merge - Genertec Swallows Up China Xinxing Corporation

News, cover

~ China General Technology (Group) Holding, Ltd. (Genertec) and China Xinxing Corporation (Group), two central enterprises managed directly by the State-owned Assets Supervision and Administration Commisssion (SASAC) of the State Council, have reached a strategic restructuring agreement which will involve Xinxing becoming part of Genertec.

~ The EO has learned that Xinxing, which is mainly engaged in construction and real estate, import and export of military supplies and medical products, has agreed to merge with Genertec rather than being forced into the hands of the recently formed Guoxin Asset Management Co, the third of China's state-owned assets management companies under SASAC.

~ The comprehensive Shanghai-based trade corporation will continue to independently manage its own personnel and business but will get financial support from Genertec after the merger.

~ Based on the financial data of the two central enterprises, if the merger plan is approved by SASAC, the assets of the new company will reach close to 50 billion yuan.

Original Article: [Chinese]

QFII's New Target: Insurance Stock

Market, page 24

~ Despite the ups and downs in China's A-share market since the start of the August, qualified foreign institutional investors (QFII) haven't altered their optimistic outlook for China's stock market.

~ This is reflected by the fact that QFIIs have not reduced their stock holdings.

~ Despite this, most QFIIs tend to pursue a conservative investment strategy, and insurance stocks are likely be their next target.

Original Article: [Chinese]