China's Political System Reform: Start With the Easy Stuff

Observer, page 41-42

By Liu Ji, former associate dean of the Chinese Academy of Social Sciences

~A key step for China to carry out political system reform is to implement democratic reforms within the Chinese Communist Party.

~ A special research team should be established to systematically study and design a plan for political reform, beginning with simple reforms. Anti-corruption responsibilities should be concentrated in the hands of the government (not the Party's Discipline Commission).

~The most urgent task for advancing political reform is reforming the present administrative management system. Governments at all levels do not need to directly manage companies. Additionally, the government should encourage the development of various organizations set up by citizens.

Original article:[Chinese]

Logic Behind Banking Fees

Nation, page 16

By Liu Zhaoqiong

~ Anyone with business sense knows that banks are not just public institutions any more. They need to make money—a lot of money, to earn more returns for the state-owned investment entity that owns bank equity as well as other shareholders.

~ Domestic banks are the easiest banks in the world with which to earn a profit. This is not only because the Chinese government monopolizes the issuance of financial institution operation licenses, but also because the banks' interest spread is covered by China's interest policy.

Original article: [Chinese]

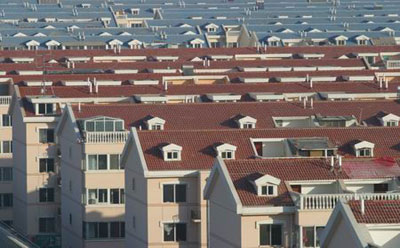

Housing Prices Won't Rebound Dramatically

EO Online

By Yang Hongxu, Researcher at Shanghai E-House Real Estate Institute

~ Housing prices cannot bounce back in a short time; otherwise, it will provoke a new set of strict price control policies.

~ If housing prices can maintain a slight drop reflected by the negative monthly growth in average housing prices for 70 major cities until the first quarter of 2011, decision-makers will feel relatively satisfied. They will likely slightly loosen present regulations on the real estate market.

Original article: [Chinese]

The Death Penalty Should Stay, but With Limits

News, page 10

Zhao Changqing, professor at Southwest University of Political Science and a leading authority on research of Criminal Law

~The amendment to China's criminal law limiting the use of the death penalty is a manifestation of progress in Chinese legislation.

~ The limit of fixed-term sentencing should be raised from 20 years to 25 years.

~ On the introduction of new drunk driving laws, present criminal laws are able to cover instances of drunk driving and drunk driving should not be listed as an independent crime.

~ The court could adopt the existing crime of “jeopardizing public security” to punish serious instances of drunk driving.

~ It is not yet time for China to abolish the death penalty, but limits on the implementation of the death penalty are necessary.

Original article:[Chinese]

Bigger is not Always Better for State-owned Enterprises

Observer, page 44

By He Shaoqi, associate professor with the China University of Political Science and Law

~ To become bigger and stronger is the goal the Chinese government has set for state-owned enterprises, but is it reasonable and will it be permanent?

~ The answer to both questions is “very unlikely”.

~ As we all know, Chinese state-owned enterprises, especially China's four largest banks, are the most profitable companies in the world, but they have earned profits not because their business performance but because they are industrial monopolies. And, the bigger and stronger monopolies are, the more ordinary consumers suffer.

~ The orginal reason the central government established state-owned enterprises was to help people and formulate a national strategy. But the State-owned Asset Supervision and Administration Commission, the only regulatory body for non-financial state-owned enterprises, is only responsible for making sure that state-owned assets are well maintained and appreciate in value.

Original article:[Chinese]

Why do Chinese People Hate Taxes?

Nation, page 16

By Xisi

~ The Chinese government claims that government revenue only accounts for 15.6% of China's entire GDP, a percentage much lower than that of America and of European countries, but Chinese people are still unwilling to pay taxes.

Why?

~ One reason is that tax revenue is not the only source of government revenue. The Chinese government receives a substantial income by selling land, imposing fines, running government funds and earning profits from state-owned enterprises.

~Another reason is that even though the government has a large revenue, only 14.9% of it is used to finance health care, education and social security, while government overheads account for 20% . With a non-transparent financial system, no one knows where the money really goes.

Original article:

Real-name Registration System vs. Individual Privacy

EO Online

By Anonymous

~ The Chinese government has imposed a real-name registration system on mobile phone users, triggering widespread concern about whether this system will violate individual privacy.

~ To be fair, this system is not completely useless. It may help expose back-door dealings, trace criminals who have released state secrets or confidential commercial information, and tackle crimes related to junk text messages and pornography.

~ What is interesting is that although the Ministry of Industry and Information Technology is the main instigator of this policy, it did not release a formal notice about its implementation. Many people are suspicious that maybe the Ministry failed to do so because the failure of Green Dam, trial version of its contentious filtering software.

So far, the new policy has already come into effect, but no one has remarked on how to protect the privacy of ordinary consumers.

Original article: [Chinese]

Who Says Two USD a Day is Middle Class?

EO Online

By Chen Tairan

~ A report released by the Asian Development Bank has recently attracted widespread attention.

~ The report defines as middle class anyone who spends two to twenty US Dollars per day. Based on this definition, the bank concludes that the Chinese middle class is composed of over 817 million people.

~ Their definition is ridiculous. In 2008, the World Bank has raised the poverty line in developing countries from one USD to 1.25 USD per day. Therefore, according to the Asian Development Bank report, people who spend 0.75 USD over the poverty line per day are considered middle class.

~The Asian Development Bank exaggerates the scope of China's middle calss in order to label it a huge market and a major power that should bear greater responsibility in the international community.

Original article: [Chinese]