Highlights from the EO print edition, Issue Wrap No. 489, October 11

This week's special October holiday issue of the Economic Observer included four special features that were put together before the extended National Day holidays in China.

Special Feature: China's Finances

News, pages 2-7

The news section of this week's paper focuses on China's "National Account Book" and features the following articles discussing recent shifts in terms of how governments, businesses and individuals spend their money:

~ The article The Somersault of this Year\'s Financial Expenditures, Who Moved my Cake? Talks about China's increasing fiscal revenue and how many local governments are still not being transparent about the amount of fiscal revenue they're collecting.

~ The article How to Spend Money: Wu Qi\'s Free Education Account takes a look at the county of Wuqi in the northwest of Shaanxi Province, where an abundance of fiscal revenue due to oil resources has led the county to spend money on providing universal education and healthcare to its citizens.

~ The article The National Grid\'s Pay Cut: The Good Old Days are Gone discusses the recent wave of self-imposed pay cuts by the national power grid.

~ The article Tears of a Small Business Owner is about a clothing export company owner named Mr. Chen and the financial struggles his small business has faced over the past 7 years.

~ The article Old Wei Sugarcane Farmer: Spending Over Half of his Savings in One Year talks about a sugar cane famer from Guangxi Autonomous Region named Old Wei and how he and his family have joined the ranks of China's consumers and spent almost all the money they had saved from their sugar cane company earnings.

~ The article The Flow and Changes of Financial Sector Salaries discusses the changes the financial sector in China has undergone and goes into detail about the money to be made in the various financial sectors such as asset management funds.

~ The article The Income Distribution Reform Spiral: Should Produce the Real Thing examines China's recent attempts to reform income distribution and discusses the changes that have been made this year and what's lacking.

Original article: [Chinese]

Special Feature: Agricultural Produce Speculation

Nation, pages 9-15

This week, the Economic Observers features an in-depth look at produce speculation on China's Agricultural Market.

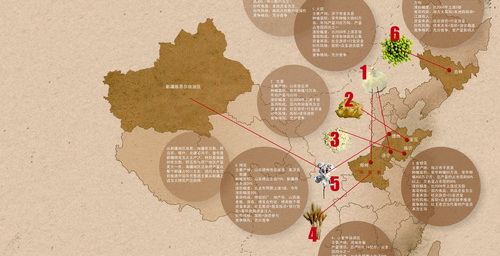

~ Speculation in China - What Products are Being Targeted?

Garlic: Shandong's Jinxiang produces over 6 million mu of garlic. Garlic is a reliable crop and garners steady expectations and consequently produces strong market liquidity. Strong market liquidity and the availability of rural brokers, all contribute to the rapid influx of hot money. The rising price of garlic has attracted local and outside speculators.

Ginger: Ginger prices have fluctuated significantly in the past few years. At a low of 0.4 yuan/kilo in 2008, the prices skyrocketed to 4.6 yuan/kilo this year. Speculating on ginger can generate huge profits. Like the garlic market, most of the money goes to brokers and middlemen.

Honeysuckle: One third of prescription medications in china list honeysuckle as an ingredient; 70% of cold and flu medications use honeysuckle. The price of honeysuckle has risen 400% this year. Annual national demand is at 20 million kilograms but actual output hovers at 8 million kilograms. Supply of honeysuckle is dependent on distributors, who are hoarding.

Green Beans: Prices have surged in the past year, from 6.8 yuan/kilo to 24 yuan/kilo.

The green bean trading volume in Taonan has reached over 40 million tons, one fourth of the entire domestic market. However, most farmers have not profited from the market surge because of poor timing, pressure to pay back loans, and planting costs.

~ What's Next?

Possible future products of speculation include: pepper, cinnamon, cumin, black bean, red bean, lotus seeds, wild mushrooms, etc.

Original article: [Chinese]

Special Feature: Investors: Ranking the Influence of Alumni from Ten Chinese Universities

Market, pages 17-23

~ This special feature ranks ten Chinese universities in terms of the success and influence of their alumni. Each school was evaluated based on the strength and quality of its education, the strength and influence of the school's alumni community, the potential for growth in influence of the school's alumni and the extent to which its alumni influences society.

~ Tsinghua University was the only university to receive full marks (scoring 20/20). Tsinghua offers outstanding programs in international business, as well as banking and insurance, while providing students a strong foundation in mathematics, technology, and analytical skills. Notable alumni include Dr. Wang Yawei of the Huaxia Fund and Dr. Li Shan of San Shan Capital Partners.

~ The Graduate School of the People's Bank of China (Wudaokou) and Renmin University both received the second highest score, with both losing one point out in the category of potential for growth of influence of the school's alumni. Renmin University's program strengths include monetary and financial theory, capital markets, and Western finance systems. The Graduate School of the People's Bank of China offers majors in banking, securities investment, insurance, and international finance.

~ Of the four universities located outside of Beijing that were evaluated, Southwest University of Finance and Wuhan University received the highest ratings. Xiamen University received the lowest score of all ten universities due to relatively poor marks in the categories of strength and influence of the school's alumni community, the potential for growth in influence of the school's alumni and the extent to which its alumni influences society.

Original article: [Chinese]

Special Feature: Crowded Skies

Corporation, pages 25-31

~ Anecdotal evidence of businessmen having trouble buying tickets on the busy Beijing-Shanghai route have been backed up by the latest statistics to show that China's aviation industry is expanding so quickly that some routes are having trouble meeting passenger demand.

~ The increase in passengers able to afford and willing to fly has pushed airports in Beijing, Shanghai, Guangzhou, Shenzhen and some other cities to full capapcity. Busy routes between Beijing-Shanghai, Beijing-Guangzhou and Shanghai-Guangzhou have also reached capacity.

~ Given the booming domestic industry, airlines, airports, ticketing agencies and even regulatory authorities are growing stronger by the day.

~ However, privately-owned airlines are still marginalized as state-owned companies have taken advantage of the recent boom to increase their strength

Original article: [Chinese]