Highlights from the EO print edition, Issue Wrap No. 496, Nov 29

Fresh Foreign Talent Heralds New Era at State Administration of Foreign Exchange

Cover

~ Since the beginning of this year, the State Administration of Foreign Exchange (SAFE), the body charged with both regulating foreign exchange and managing China's 2.65 trillion U.S. dollars worth of foreign exchange reserves, has engaged in a series of open-market operations that have won it increased respect.

~ SAFE bought 2.31 trillion yen worth of Japanese bonds during the first seven months of this year, before selling many in August and September, earning a yield rate of between 9 and 10 percent. Meanwhile, it also earned considerable profits by trading in U.S. treasury bonds.

~ Zhu Changhong, chief investment officer of the administration's reserve management department, is believed to be partly responsible for the shift in investment strategy at SAFE. Zhu used to head the derivatives desk at the Pacific Investment Management Co. hedge-fund (Pimco), before joining SAFE earlier this year.

Original article: [Chinese]

Where Local Government's Bank their Funds - Holes in the System

Where Local Government's Bank their Funds - Holes in the System

News, page 3

~ Zhang Meifang, former deputy director of the Jiangsu Provincial Finance Bureau, won't have a chance to bank the 1.1 million yuan cheque she received from a local commercial bank - as she's already been detained by the authorities.

~ The cheque was a kickback. In return for agreeing to deposit a portion of the provincial government's fiscal funds with a particular bank, the bank wrote Zhang Meifang a cheque. Zhang is the first Chinese financial official to be detained for receiving a kickback from a bank based on her decision to deposit funds with them.

~ According to Chinese law, all fiscal revenue should be deposited in the central bank or its local subsidiaries. However, the EO has learned through investigation that many local governments have begun to deposit a portion of their fiscal revenue, as well as their entire off-budget revenue, in commercial banks so as to take advantage of the higher interest rates.

~ The competition among banks to attract the deposits of local governments creates plenty of room for corrupt behavior.

~ According to statistics released by the Chinese Academy of Social Science, China collected 660 billion yuan in revenue in 2009 that was not included in the official budget. Experts say, China has to combine budgetary revenue and off-budget income in a single accout in order to avoid the emergence of a second Zhang Meifang.

Original article: [Chinese]

NDRC Issues Nine Notices in Five Days in Bid to Curb Rising Prices

News, Page 4,

~ The National Development and Reform Committee (NDRC) issued nine notices related to curbing rising prices in the five days following November 20.

~ Aside from the announcements, the central government has also taken other steps to stabilize prices, including handing out fines to companies that had breached pricing regulations, producing daily reports on the price of staple foods, urged local government to start providing subsidies to lower-income groups and urged provinvicial and municipal government to ensure the affordability of basic vegetables and grains.

~ China Central Bank increased the reserve requirement ratio on November 19 for the second time this month. All these meatures and moves show that China is now well and truly committed to combatting inflation.

Original article: [Chinese]

Foreign Drug Producers Fight for a Place on China's New List of Basic Medicines

News, page 6

~ The Shanghai government has delayed the publication of its list of "basic medicines", a list of essential medicines that the government will offer at low prices as part of a nationwide reform of drug pricing. The delay is said to be related to the lobbying of foreign drug companies asking to be considered as potential suppliers of the drugs on the list.

~ Shanghai is not alone. As China moves the focus of its reform of the country's health care system, the domestic market for medicinal drugs is expected to expand to 200 billion yuan within three years, a number which has attracted the attention of many foreign drug producers.

~ Currently, 70 percent of drugs prescribed by doctors in first-class hospitals in China are manufactured by foreign companies.

~ As some international drug giants, including Merck Sharp & Dohme, Novartis and Johnson & Johnson, have been under investigation in the United States for attempts to bribe practitioners and have had their products recalled many times, some local governments are reluctant to turn to them as suppliers of the "basic medicines".

Original article: [Chinese]

CBRC Assessing Bank Data on New Capital Rules

Market, page 18

~ Over the coming five years, financial reform in China will shift from focusing on internal reforms of individual financial institutions to the establishment of an anti-cyclical macro-financial management system.

~ Based on the Basel III Agreement, the China Banking Regulatory Commission (CBRC) has raised the required ratios of core tier 1 capital, tier 1 capital and overall capital to the risk-based assets of commercial banks to 5, 6 and 8 percent respectively. Only the first index, the ratio of core tier 1 capital to risk-based assets is higher than the international standard of 4.5 percent.

~ Aside from those three internationally-accepted indexes, the CBRC has also created a fourth measure for commercial banks: the loan-loss provision ratio, a ratio to prevent risks of bad loans. The CBRC has required that the loan-loss provision ratio of commercial banks should be no less than 2.5 percent.

Original article: [Chinese]

Foreign-invested Investment Banks are Losing the Battle for Domestic IPOs

Market, page 21

~ On November 25 the chairman of Greater China for the Royal Bank of Scotland (RBS), Lan Yuquan informed the EO that the China Securities Regulatory Commission (CSRC) will soon announce the approval of the establishment of Hua Ying Securities, a joint venture securities firm established by Guolian Securities and RBS.

~ Even though many new joint ventures with foreign firms are being established in China, the development of investment banks with foreign capital has not been smooth. Of the 419 firms that listed on the domestic board this year, foreign-invested investment banks only backed 19 of these IPOs accounting for a mere 4.72 percent of the total revenue raised via IPOs, even Goldman Sachs, through their joint venture with Beijing Gao Hua Securities (Goldman Sachs Gao Hua Securities Company) has struggled.

~ The biggest problem for foreign investment banks in China has been that they previously only focused on high end projects, but do not pay enough attention to small and medium-sized companies, said Fei Xiang, the head of the investment department at Zhong De Securities.

~ UBS and Goldman are looking for enterprises with high growth potential in China, in order to improve the situation.

Original article: [Chinese]

Mengniu Acquires Stake in Junlebao Dairy

Corporation, page 25

~ Mengniu Dairy, China's largest dairy firm by market value, bought a 51 percent stake in Junlebao Dairy, valued at 469.2 million yuan, to become the company's majority shareholder on November 22.

~ The merger is likely a move to ward off competition from other dairy companies, such as Yili Dairy, especially in the yogurt field.

~ Junlebao Dairy stated that the reason they choose Mengniu from various potential buyers, is that they will be able to maintain "independent development" after the merger.

~ The merger has raised the issue of the likelihood of small- and medium-sized dairy enterprises being gobbled up by larger firms. The large players in the sector buy up the competitive emerging companies, with each merger bringing the sector one step closer to being controlled by an oligopoly.

Original article: [Chinese]

A Turning Point in the War against Piracy

Corporation, page 30

~ Last year, popular Chinese internet portal Sohu and Ku6, an online video sharing site, united to form an anti-piracy alliance that pursued other websites for infringing on their copyright. The move caused the price of rights to display television shows online to increase dramatically.

~ However, as the price of copyrighted content quickly exceeded a level that the market was willing to accept - the online airing rights for a 40 to 50 episode television series climbing into the hundreds of thousands of yuan - many websites still chose to air pirated material.

~ At the beginning of this year, legal, copyright-abiding content represented only 5 percent of all television dramas and film available to watch on the internet.

~ But recently, the market for online films and dramas has been changing.

~ October saw significant gains in the fight against piracy. Popular online video sharing site Tudou, which recently filed for an IPO, and Xunlei, a popular download manager and bit torrent client, are both said to have removed pirated versions of American TV series.

~ On November 12, the State Administration of Radio, Film, and Television (SARFT) issued "Suggestions for the Protection of Intellectual Property," other central ministries have also indicated that they are cracking down on online piracy.

~ Video streaming sites are more willing to negotiate purchasing the rights to television dramas and films. They can then sell or lease the distribution rights to other sites.

~ This has caused the price of online distribution rights to rise dramatically.

Original article: [Chinese]

Ten Billion Yuan Public Housing Rental Fund Breaks Ground

Property , page 37

~ The aim of public housing is to provide housing to citizens who cannot afford commercial residential properties due to unemployment or other financial difficulties. The houses are owned by the government or public institutions, who rent them to individuals who meet certain criteria at below the market price.

~ The main purpose of founding a public housing rental fund is to help subsidize local governments who lack the funds required to construct housing, according to Ren Zhiqiang, the well-known chairman of the Beijing-based Huayuan Real Estate Group.

~ The fund will also serve as a bridge between real estate companies and local governments.

~ Li Xiaodong, Chairman of J&J Capital, has forcast that public housing will be rent out at between 60 to 80 percent of the market price, which will still provide a profit according to his calculation.

Original article: [Chinese]

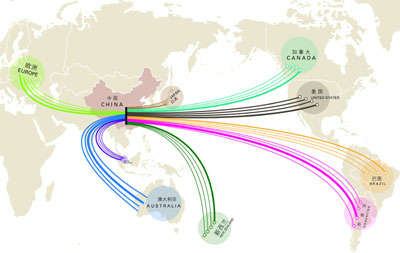

Special Feature: A Survey of Chinese Emigration

Nation, page 9-12

~ Since China opened its borders in the 1970s, there have been three main waves of emigration. The latest wave of emigrants comprises of China's wealthy and intellectual elite.

~ The past decade has seen the proliferation of investment immigration. Wealthy Chinese apply for investment immigration visas so their children can attend schools abroad. Most continue to work in China.

~ Canada, the US, and Australia remain the most popular destinations for Chinese emigrants. But Brazil, Argentina, United Kingdom, Germany, and Japan have are also marketing investment visas to wealthy Chinese.

Popular Destinations for Investment Immigrants:

CANADA

Requirement: 10.5 million RMB in assets, and an investment of 800,000 Canadian dollars

Waiting Period: 1+ years for a visa

Immigration Degree of Difficulty: Relatively Easy

USA

Requirement: EB-5 visa, 3.33 million RMB

Waiting period: 3-6 months for a visa, 9-12 for a green card

Immigration Degree of Difficulty: Medium

BRAZIL

Requirement: Investment of 500,000 RMB

Waiting Period: 9 months

Immigration Degree of Difficulty: Relatively Easy

ARGENTINA:

Requirement: Investment of 670,000 RMB

Waiting Period: under a year

Immigration Degree of Difficulty: Easy

NEW ZEALAND:

Requirement: IETSL Level of 3 or higher, an investment of 7.54 million RMB; IELTS level of lower than 3, an investment of 50.27 RMB

Waiting Period: 6 months

Immigration Degree of Difficulty: Easy

AUSTRALIA

Requirements: (Over 132 types of immigrants) 2 years in the past 4 with a 10 percent share in the company worth over 2.58 million RMB, or company turnover of over 19.33 million RMB in 2 of the past 4 years, or Family assets exceeding 96.6 RMB

Waiting Period: None

Immigration Degree of Difficulty: Medium

SINGAPORE

Requirements: (Starting next year) investment of 12.63 million; for companies: a turnover of over 150 million RMB

Waiting Period: 1 year for a green card (the bigger the investment, the faster the process)

Immigration Degree of Difficulty: Relatively Easy

EUROPE

Cost: For the UK, an investment of 52.21 million RMB; for Germany, an investment of 220,000 RMB

Waiting Period: Indefinite (2-3 years to be eligible for citizenship in the UK; 3 years for a green card in Germany)

Immigration Degree of Difficulty: Relatively Difficult

JAPAN

Cost: Investment of 790,000 RMB

Waiting Period: Around 6 Months

Immigration Degree of Difficulty: Traditional immigration difficult, but comparatively low requirements for investment immigrants

~ Immigration lawyers from the Wei Hang law firm say emigrants move abroad for a sense of social and economic security and a better legal environment.

~ Developed countries also offer a more comprehensive health-care system, a better living environment, and a safer consumer environment.

~ The number one reason for emigrating remains the children.

~ Primary and secondary education in developed countries are either free, low cost, or provide accessible funding. Emigrating also allows parents to pick and choose the schools their children attend.

The feature also includes in-depth surveys of who the emigrants are, why they are leaving, what they are hoping to find, and expert views on the state of Chinese emigration.

Original article: [Chinese]