Highlights from the EO print edition, No. 594, Nov 12, 2012

Debate Over Pushing Back Retirement Age Heats Up

News, Page 3

~ The policy debate over whether to extend China’s official retirement age is beginning to heat up. Late last month, the spokesperson for the Ministry of Human Resources and Social Security (MOHRSS), used the phrase "steady and careful promotion" (稳慎推进) when discussing possible moves to push back the retirement age. The spokesperson also noted that other countries also took a very gradual approach when altering their retirement age policies.

~ Advocates of reform include Zheng Bingwen (郑秉文), the director of the World Social Security Research Center at the Chinese Academy of Social Sciences. Zheng recently said that the country had no other option but to push back the retirement age.

~ Tang Jun, another researcher with the Chinese Academy of Social Sciences, noted that it’s important to understand that in addition to corporate and individual contributions, the government has an important role to play.

~ The EO learned from a person connected to the China Democratic League (中国民主同盟), one of the eight legally recognized political parties in China, that the party had recently submitted a report to the central leadership that included a proposal that 30 percent of all government spending should be directed into Social Security.

Original article: [Chinese]

Under Pressure: China’s Public Servants Feel the Heat

Nation, page 9

~ Despite a stable income, generous welfare provisions and a modicum of social status attracting many new graduates to compete for places in China’s civil service, a recent report suggests that the county’s public servants are starting to bear the brunt of growing social pressure.

~ In the first half of this year, the counseling center that looks after the mental health issues of central public servants issued a research report into the health of civil servants. While the report noted that 74.1 percent of civil servants working at the central level felt they led very happy lives, more than 60 percent of civil servants reported being under moderate or heavy pressure. Of this 60 percent, 13.5 percent said they were under heavy pressure or extreme pressure.

~ In fact, despite the desire of many to land a government job, many civil servants suffer from anxiety, insomnia and depression.

~ In this article, the EO talks to three public servants about the pressure of their jobs.

Original article: [Chinese]

CNCRC Fully Stocked but Outlook Is Unclear

News, Page 5

~ Recently, China National Cotton Reserves Corporation (CNCRC) – the state-owned industry charged with managing China’s cotton reserve - has been enforcing new policies to relieve inventory pressure.

~ On Nov 5, a new contract system was introduced. CNCRC signed contracts with big corporations like China Co-op Group and the Cotton & Hemp Company of Xinjiang Production and Construction Group in attempt to relieve inventory pressure.

~ With banks pressing for payment on outstanding credit, many people in the cotton business have had to dispose of their inventory during unfavorable market condtions.

~ “Shipments of imported cotton have been sold at a fire-sale prices,” said Li Qunxian (李群先), the vice general manager of a cotton trading company in Ningbo. “Some traders even made deals where they lost 6,000 yuan per ton”

~ Now many bonded warehouses – places where imported goods are stored without paying duty - are emptying.

~ Jia Shaobin (贾韶斌), the general manager of Qingdao Hongchuan Logistics Company, which specializes in cotton deals, told the EO that the inventory of imported cotton is dropping faster than he was unprepared for.

~ “Traders barely have any cotton in hand,” said the general manager of a Shandong cotton company. “No one wants to hoard cotton that you don’t make any money on.” He believed that more of the cotton is in the national repositories.

~ According to information from an insider, although CNCRC is under a tight inventory environment, it won’t sell at a loss. In mid-September, CNCRC sold almost 500,000 tons of its inventories at 18,500 yuan per ton.

~ By his account, the country is storing cotton, and the price is below 19,000 yuan per ton. With inventory going into CNCRC’s warehouses, less cotton is left in the market for textile enterprises in need of cotton. So the market price is bound to rise.

Original article: [Chinese]

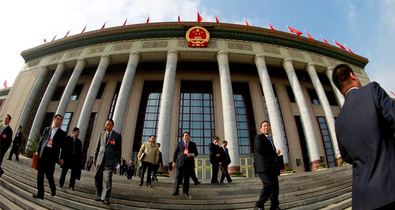

Party Delegates from Private Enterprises

News, cover

~ This year, 34 out of the 2,270 delegates at the 18th National Congress of the Communist Party are private entrepreneurs.

~ Ten years ago, the 16th Party Congress was the first time private entrepreneurs appeared as delegates. There were only seven at that time, and 17 and the 17th National Congress five years later.

~ “Looking from the numbers, the delegates from private enterprises have been greatly increasing,” said Wang Dong (王栋), chairman of Gansu Dayu Water-saving Co., Ltd (大禹节水) and one of the 34 private entrepreneur delegates. “This is the Party’s recognition for the development of private enterprises in recent years, and also that the Party allows private enterprises to take part in the decision-making of the state’s fundamental policies.”

~ From Wang’s point of view, since the 16th Party Congress, the country has started to attach greater importance to private enterprises. The original monopoly areas have been gradually opened up, giving private enterprises more and more room for development.

~ Chen Ailian (陈爱莲), chairman of Zhejiang Wanfeng Aote Holding Group Co., Ltd., who was a delegate at the 17th Party Congress, says that the title of party delegate is one of the best business cards for entrepreneurs. “After being a party delegate, the contact level is not the same, and the thinking level is also not the same,” he said.

~ Currently, registered private enterprises have reached more than 9 million in China, and individually-owned businesses are more than 36 million. Non-public sectors of the economy now make up more than half of the national gross domestic product.

Original article: [Chinese]

BYD Adjusts Market Promotion Strategy for Electric Vehicles

Auto, page 33

~ According to statistics by McKinsey, China sold a total of 48 million vehicles in the 42 months from January 2009 to June 2012. However, only 7,834 were electric vehicles, accounting for just 0.02 percent of the total.

~ BYD’s two-year electric car pilot program in Shenzhen showed that pure electric vehicles are more suitable for city public transportation systems than private consumers. From this conclusion, BYD is changing its promotion strategy.

~ “Subsidies are a short-term action for sure,” said Wang Chuangfu,chairman of BYD. “The market-orientated [development] path is the direction we must adhere to for promoting electric vehicles.”

~At the end of October, BYD signed a contract with UK’s second largest taxi company, Green Tomato Cars. Fifty BYD e6 electric taxis will be introduced to London to make the city’s first purely electric taxi fleet. These 50 vehicles will be delivered in early 2013.

~ At the same time, BYD’s K9 electric bus has also received many orders from the Netherlands, Israel and Hungary.

~In the domestic market, the greatest challenges facing BYD in promoting electric vehicles for public transportation come from regional protectionism and misunderstanding toward electric vehicle technology.

~ Wang said local governments tend to purchase products made by local enterprises. The solution to this problem is to establish local factories. BYD has decided to set up factories in Tianjin and Yunnan Province.

Original article: [Chinese]

PICC to Go Public With H-Shares

Market, page 20

~The People’s Insurance Company of China (PICC) is planning its Initial Public Offering (IPO) for Nov 26 in Hong Kong, with trading to start on Dec 7.

~According to Reuters, Goldman Sachs is expected to be one of PICC’s sponsors for H-shares, which are shares of companies incorporated in mainland China that are traded on the Hong Kong Stock Exchange. Three others are China International Capital Corporation (CICC, 中金), Credit Suisse (CS, 瑞信) and Hong Kong and Shanghai Banking Corporation (HSBC, 汇丰).

~ It’s been disclosed that there are 17 investment banks involved in PICC’s IPO listing, but it isn’t yet clear how responsibilities will be divided.

~ In preparations for going public, PICC has mulled both launching A-shares and H-shares simultaneously and launching H-shares first. Eventually, it opted for the latter so it could launch its IPO in 2012.

~ Sources relevant to PICC said that the company would like to make its A-share IPO as well, but that mostly depends on the China Securities Regulatory Commission (CSRC). If the H-shares start before the A-shares, then the company doesn’t need to go through listing procedures again later.

~The sources also said that the ideal offering price is 8 to 9 yuan per share. However, the agency-valuated price is around 5 yuan per share.

~ Interim statements show that the net profit of PICC Property & Casualty (PICC P&C) over six months was 6.3 billion yuan with 12.2 billion yuan of capital stocks, earning 0.5 yuan per share.

~ However, the dark climate of overseas investment brings many uncertainties to PICC’s upcoming IPO.

~ Dragged down by stock markets in Europe and the US, the Hang Seng Index closed at 21,566.91 on Nov 8 after a drop of 2.41 percent - the biggest drop in three-and-a-half months.

~ However, the company’s combined ratio – a measure of profitability used by insurance companies - was 92.4 percent in the first half of the year, higher than the industry average. The company has praised itself for being the biggest money maker in China.

Original article: [Chinese]