Highlights from the EO print edition, No. 573, Jun 11, 2012

China's Banks Under Pressure after Interest Rates Cut

News, cover

~ On the evening of June 7, China's central bank, the People's Bank of China announced that it would cut benchmark interest rates. While many viewed the announcement as a favorable sign, it's going to put a lot more pressure on China's commercial banks.

~ This is not the only announcement that will put pressure on the banks. On the following day, the China Banking Regulatory Commission (CBRC) issued new capital management measures for commercial banks that will come into effect on Jan 1 2013. This means that come next year, banks will have strict requirements in terms of risk management.

~ In addition, banks are also about to be hit by a potential spike in non-performing loans as many of the loans that were pushed out the door with the 2009 stimulus will enter their peak repayment period over the next three years.

~ While announcing the latest interest rate cut, the People's Bank of China also gave the country's banks more leeway in setting rates - they can now offer depositors up to 1.1 times the benchmark rate and lend cash out as cheaply as 0.8 times the benchmark lending rate.

~ On June 8, all five of China's largest state-owned commericial banks (the Industrial and Commercial Bank of China, China Construction Bank, Bank of China, Agricultural Bank of China and Bank of Communications) announced that they would set their one-year term deposit rates to 3.5 percent, which is close to the central bank's new limit above the official 1-year deposit rate of 3.25 percent.

~ J.P. Morgan believes that although the interest rate cut might serve to encourage loan growth, it also means that the spread between deposit and lending rates will shrink, squeezing the banks' profit margins.

~ Chinese banks made about 80 percent of their profits from the interest rate spread.

~ In 2011, when other industries all encountered negative growth, China's banking industry achieved a total net profit of over 1 trillion yuan, an increase of 36.3 percent, according to data collected by CBRC.

Original article: [Chinese]

Electricity Regulator to Open Power Industry to Private Capital

News, page 2

~ The EO has learned that the State Electricity Regulatory Commission (SERC) is working on provisions to allow private capital to invest in the power industry – both the generating sector and the national grid, which until now has always been a state monopoly

~ The commission will allow investors into sectors such as thermal power, hydropower and nuclear power, and, say people familiar with the issue, these investors may be able to hold stakes in the national grid but with more restrictions.

~ The provisions are scheduled to be introduced within the year.

Original article: [Chinese]

Not Black and White for Newspaper Ownership in China

Nation, page 9

~ The founder of English Coaching Paper (英语辅导报), a weekly newspaper written in English and read by school children across the country, has failed to win independent ownership on the publication.

~ Bao Tianren (包天仁) was forcefully removed from his position a year ago, when an official from the local government of Tonghua City, Jilin Province was installed in his place.

~ The case highlights the dilemma that Chinese media have been facing for decades. In theory Chinese publications fall into two categories - official newspapers and independent papers - but in fact, they're registered as either public institutions or state-owned enterprises.

~ For English Coaching Paper, the local government and its registered supervisor, Tonghua Normal School, neither invested nor managed the paper, but the paper is still considered as "state-owned."

~ The General Administration of Press and Publication in 2010 introduced reforms aimed at making newspapers more market oriented, but there is little optimism about the prospects for ownership reforms.

Original article: [Chinese]

15,000 Hebei Officials "Go Down to the Countryside"

Nation, page 14

~ Hebei Province is in the process of sending officials down to the countryside. Since Feb 2012, approximately 15,000 officials have been assigned to 5,010 of the province's more than 50,000 villages. The villages chosen to host the officials are generally those that are lagging in economic development or have poor environmental conditions. The officials will separate from their regular work unit and live in the villages.

~ Last month, the Hebei government announced the goal of completing poverty alleviation in areas surrounding the national capital of Beijing. Zhang Qingli (张庆黎), secretary of the CPC Hebei Provincial Committee, said the province will dedicate the resources of the whole province to help these poor villages get out of poverty by increasing fiscal investment. The government plans to make significant improvements to basic infrastructure such as roads, communication, housing, water and electricity.

~ At the beginning of 2012, cities such as Zhangjiakou (张家口) and Baoding (保定) have complete their plans of Yanshan Mountains-Taihang Mountains Regional Development and Poverty Alleviation.

~ According to a report from the Asian Development Bank published in 2005, there was a "zone of poverty" that surrounded Beijing - which included 32 poverty-stricken counties, which for reasons of environmental and ecological protection, had only limited industrial zones.

Original article: [Chinese]

Foreign Banks Increase Capital in China

Market, page 19

~ As the Chinese government begins to loosen capital controls, foreign banks are increasing their exposure in China despite the fact that their market quota has only increased by 0.11 percent over the past decade.

~ From last Nov, HSBC (China) began gradually to increase its registered capital from 2.8 billion to 10.8 billion yuan; on May 28, JP Morgan transferred 2.8 billion to its China arm and on May 31, UBS gained approval from the China Banking Regulatory Commission to conduct RMB business in Mainland China.

~ Additionally, Citi Bank, Royal Bank of Scotland, DBS Bank and Nanyang Commercial Bank are also transferring more capital to their China operations.

~ Foreign banks have been in an unfavorable position when competing with its Chinese counterparts over the past decade. Since 2008, they are reported to have suffered huge loses due to poor internal management and being edged out of the domestic loan market.

Original article: [Chinese]

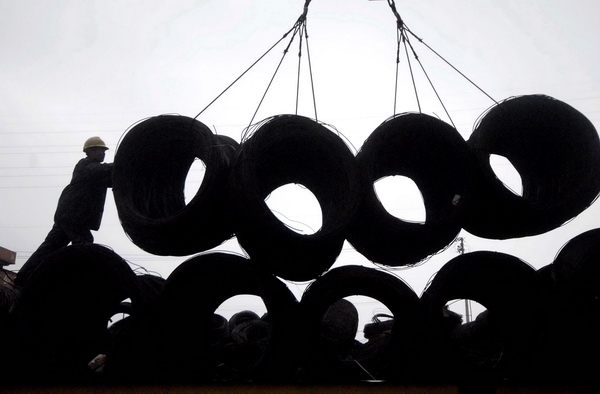

Steel Traders Relying on Shell Companies To Get Loans From Banks

Market, page 20

~ With banks restricting loans to steel traders, businesses have had to use their imagination to get credit–creating new shell companies that can pass through the loan approval process.

~ One person working in the industry told the EO that most traders own five to ten shell companies registered under the names of their relatives and friends. He said that few of the companies that they used to secure credit do any steel trading at all, while some are in associated sectors, such as construction, and others, such as local fisheries associations, have no connection to the industry whatsoever.

~ Banks have long been are aware of - or even complicit in - steel traders' use of shell companies to circumvent their lending restrictions, but they are only now beginning to take action to curtail easy credit because of the heightened risk of bad loans.

~ Banks considering loan applications are now paying more attention to daily accounts rather than faked paper bills, said one employee.

~ Some have blamed banks' tighter lending policies for the recent bankruptcies at steel trading companies – when loans matured, rather than rolling them over, the companies had to repay the banks using cash borrowed privately at much higher rates.

~ The banking watchdog, the Central Banking Regulatory Commission, said that steel traders made a loss of 1.034 billion yuan in the first three months of 2012, compared to a 25.8 billion yuan profit in the same period last year. The commission expects the steel traders to continue to struggle this year.

Original article: [Chinese]

The Listing of the God of Fortune Temple

Corporation, page 25

~ A newly built temple devoted to the God of Fortune has been included as one of the business under the control of the Shanghai-listed ST Changxin (ST长信). The company is currently being restructured and as part of this process, the Xi'an Qujiang Cultural Tourism Group Co. Ltd (西安曲江文旅集团), which currently operates the temple, began to hand over control of the temple from May 31. Income from ticket sales and other commercial operations like performances and souvenirs were included in the deal.

~ As part of the ongoing project of Louguantai God of Fortune Cultural District (楼观台财神文化区), the temple was built for five Gods of fortune. Yang Tao (杨涛), head of ST Changxin and former vice president of Qujiang Cultural Tourism Group explains that the temple is not a real temple but a cultural tourism site. "Just because it has the word temple in the name, doesn't mean it's a temple," says Yang, "and temples are not all used for religious purposes. There are different temples such as the Confucius temple (文庙) and the Guan Gong Temple (武庙) and they all have different purposes."

~ Yang says with this project they want to provide traditional culture to the tourists and make profits for the investors. "We are not qualified or willing to manage a temple if it really was a temple."

~ Apart from the new temple for the God of Fortune surrounded by shopping malls and restaurants, the EO's journalist also learned that there is an old temple three kilometers away. According to the Taoist priest in the old temple, the local government wanted to demolish the old temple and build a new one in its place, but the idea was rejected. The new one was later built on a different site.

~ "I think that is a tourism project and a tourist site. But you can decide for yourself whether you think it's a temple or not" said the priest.

~ However Liu Wei (刘威), director from the State Administration for Religious Affairs, said on June 5 that temples are non-governmental organizations for religious activities and no temple had ever been listed anywhere before. Wang Zuo'an (王作安), minister of the State Administration for Religious Affairs also stated that "religious sites should not be listed as part of the assets of an enterprise." Wang also emphasized that "unlike personal donations, enterprises are not permitted to take shares in a temple. It's forbidden to make profit from religion." He also added that the bureau will draft regulations on the issue together with other departments.

~ Currently there is still no specific regulation on whether a religious tourist site can be listed. The EO also learned that Qujiang Cultural Investment (曲江文投), the main shareholder of the Qujiang Cultural Tourism Group, has also invested in a similar site, the Famen Temple Cultural site (法门寺文化景区) and the company managing that "temple" also planned to hold an IPO last year.

Original article: [Chinese]

Nestlé To Train Dairy Farmers in Heilongjiang

Corporation, Page 30

~ Nestlé last week announced a 180 million yuan project to build a 600,000 square meter dairy management and training center in Heilongjiang province, in north east China.

~ The center will be dedicated to teaching Chinese farmers how to build their own farm and raise cattle. The first phase of this project should be finished by the end of 2012.

~ Nestlé is also seeking to set up a "Financial Credit Guarantee Platform" to help farmers get access to loans.

~ Since 2008, when the melamine scandal led many to believe that well-known brands of Chinese milk were unsafe to drink, the government has tried to encourage consolidation in the dairy sector, forming larger cattle farms from the small individual milk producers that had been supplying milk to the big brands.

~ The vice major of Shuangcheng (双城), the city where Nestlé’s center will be based, said that Nestle had benefited from many preferential policies.

~ Vice mayor Wen Liheng (文立恒), said Nestlé received 10,000 square meters of free land and Nestlé said that the training sessions would also be free for farmers from the area.

~ Nestlé's three main milk production areas in China are Shuangcheng(双城), Hulun Buir (呼伦贝尔) and Qingdao (青岛). The company been encouraging consolidation in the dairy sector here, as well as trying to secure exclusive access to their produce.

Original article: [Chinese]