Issue Wrap No. 459, March 8

Highlights from the EO print edition, issue no. 459, March 8, 2010

China Launches Second-round of Taxation Inspection in Bid to Boost Revenue

News, cover

~ Starting last October, China's State Administration of Taxation (SAT) began asking local tax collection agencies to carry out inspections of the tax declarations of 63 large companies. The move was made at a time when it seemed likely that China would not reach it's fiscal revenue or tax revenue growth target for 2009 and was an obvious bid to boost revenue,

~ All of the 63 enterprises involved were ordered to conduct internal reviews of the tax declarations they had lodged over the past three years .

~ The SAT will continue to try and squeeze more "additional tax" from large businesses this year and have already set a target of collecting no less than the equivalent of 1.5 percent of the total national industrial and commercial taxation revenue budget in additional tax this year.

~ A rough calculation indicates that the SAT is aiming to collect over 100 billion yuan in additional tax in 2010.

~ The SAT collected 119.2 billion yuan of additional tax revenue in 2009, helping to achieve the goal of 8% percent annual growth in national taxation revenue with revenue up 8.2% last year.

~ The EO learned that the industries expected to be targeted in this year's second-round of tax inspections were likely to be pharmaceutical companies, real estate developers and large groups involved in construction and transportation.

The tax office also plans to raise extra funds from the boost to income tax likely to accompany the trading of a large number of formerly non-tradable shares entering the stock market.

Original article: [Chinese]

Weighing Risk: Bank Executive Pay to be Tied to Risk Management Performance

News, page 5

~ To reduce and prevent potential banking risks causing instability in China's banking system, the China Banking Regulatory Commission (CBRC) is studying a plan to link the income of high-level bank executives to their ability to manage risk.

~ The proposed new payment system will divide the income of banks executives into three fundamental areas: basic pay, performance-related pay and long-term inducements.

~ According to the plan, performance-related pay will be determined by how much risk the executives have exposed the bank to with a focus on the capital adequacy ratios, bad loan ratios and other factors.

~ The CBRC may even require banks to cancel any bonus payments made executives if they are later found to have engaged in business that exposed the bank to excessive risk.

~ There is also a suggestion that banks should delay paying executives until after it's possible to assess the quality of their risk management.

Original article: [Chinese]

Ministry of Environmental Protection Gets Teeth: Administrative Detention for Serious Offenders

News, page 6

~ The Ministry of Environmental Protection (MEP) has issued a newly-amended version of the document outlining penalties for violations of China's Environmental Protection Laws.

~ The Measures for the Administrative Penalties for Environment Protection were released on March 1, replacing the previous measures which were issued ten years ago.

~ The new legislation clearly states that repeat offenders a liable to be sentenced to administrative detention.

~ At the same time, the new regulations will be supervised and implemented by two authorities: the Ministry of Environmental Protection and an authorized environmental monitoring agency.

~ This is the first time the measures have been modified since the departments name was changed from the Environmental Protection Administration to the current Ministry of Environmental Protection two years ago.

~ An MEP official who deals with complaints said, "the introduce of this new measures has increased the intensity of the fight against environmental violations, the punishment will be more rigorous."

Original article: [Chinese]

Will Central Enterprises Continue to Play an Active Role in Land Purchase in 2010?

Nation, page 7

~ In a panel discussion held on the sidelines of this year's top political consultative session, Wang Jianlin, chairman of Dalian's Wanda Group Corporation and a member of Chinese People's Political Consultative Conference (CPPCC), lashed out at central enterprises purchasing plots of land at inflated prices. He said soaring house prices was mainly being driven by the rise in the price of plots of land.

~ Zhang Hongming, a member of the CPPCC, submitted a proposal to the on-going conference that called for centrally-owned enterprises, state-owned companies that are under the control of central government departments or ministries, to exit the real estate market.

~ In 2009, many central enterprises made headlines when they bought plots of land for record-breaking prices at government land auctions.

~ Available data showed that over the course of last year, over 90 "land kings" emerged across the country, basically companies that paid record prices for the rights to develop property in certain area, some 67 percent of these "land king" purchases were made by central enterprises.

~ The trend has continued into this year with central enterprises continuing to spend big at land auctions. A recent example is that of OCT Enterprises, the company spent 7.02 billion yuan in acquiring a 35,600 square meter plot in Shanghai.

~ Chen Guoqiang, director of the Real Estate Institute at Peking University, said that some central enterprise would continue to invest in real estate as long as their regular business performance remained depressed.

Original Article: [Chinese]

Wen Reveals China's Macro-economic Policy Fundamentals for Coming Year

Special Feature, page 10

~ China will stick to its proactive fiscal policy and so-called "moderately-loose" monetary policy and maintain the continuity and stability of macro-economic policies in 2010, Premier Wen Jiabao announced in his reading of the government work report last Friday.

~ Wen also declared that China would remain flexible in terms of its attitude to the above policies depending on how the situation develops.

~ The work report went on to reveal that the estimated budget deficit for 2010 is 1.05 trillion yuan, with central government spending accounting for 850 billion of the deficit and bonds issued on behalf of local government making up the rest.

~ Wen pledged to strengthen the economic recovery by maintaining current policy-settings, while, simultaneously, promoting economic restructuring and making changes to the country's economic growth model a priority.

Original Article: [Chinese]

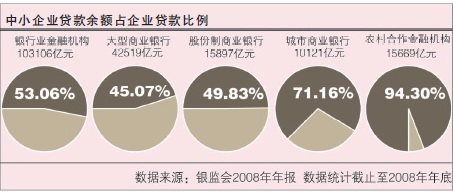

Bankers Urge Reforms to Small Business Financing

Special Feature, page 11

~ Small businesses account for 99% of the total number of Chinese companies. They're full of economic vitality and have become an important engine of China's economic growth. They also play an importnant role in encouraging technological innovation, the development of regional economies, industrial restructuring, and providing employment opportunity.

~ However, the problem of getting access to finance has become a serious constraint on the development of small- and medium-sized enterprises (SME) in China.

~ At the current "two sessions," several representatives from China's banking sector, including Ma Weihua, Chairman of China Merchants Bank; Dong Wenbiao, Chairman of China Minsheng Banking and Yan Bingzhu, Chairman of Bank of Beijing, jointly appealed to the related departments to adopt measures that encourage commercial banks to offers loan to SME.

Original Article: [Chinese]

CPPCC's No.1 Proposal Focused on Low-carbon Economy

Special Feature, page 13

~ When interviewed by EO and other media, Lai Ming, vice chairman of the Jiu San Society, one of the eight officially-recognized alternative political parties in China, revealed that the party's proposal to "Seize the Opportunity and Develop a Low-carbon Economy with Chinese Characteristics" had been chosen as the official No.1 proposal to be discussed at this year's on-going political consultative conference.

~ The proposal argues that the central government should integrate policies concerning energy-saving and emission reduction into a low-carbon economic development model.

Original Article: [Chinese]

Stock Markets Expected to Rise After Seven Rough Months

Market, page 17

~ It's been a rocky ride for China's domestic stock markets over the past seven months, but according to some analyts, A-shares will begin to advance again soon.

~ Discouraged by recent macro-economic policy shifts, and fears that liquidity would be mopped up, A-shares have endured a turbulent period over the past seven months and there's also been a decline in trading volume.

~ However, with an increasingly more optimistic macro-economic environment, some analysts a predicting that China's A-shares will not remain in the doldrums for much longer and that an A-share rally is just around the corner.

Original Article: [Chinese]

Pulling Back on Housing Loans: Banks Reduce Rate of Cash Offered for Collateral-backed Loans

Market, page 19

~ Recently, an executive of a stock company had his application for a personal loan from China Merchants Bank refused. In the past, a house worth RMB 1,000,000 could be used as collateral to loan up to 700,000 yuan from the bank, now the same house would only give you access to little more than 50,000 yuan.

~ This change may have been caused by the China Banking Regulatory Commission's (CBRC) recent issuing of the Housing Mortgage Risk Warning Notice. According to the notice, commercial banks should be stricter in their evaluation of the valuation of collateral and prudent in their judgement of what to accept as collateral.

~ Though new loans have continued to grow in 2010, commercial banks have already pulled back on loans to real estate development projects and personal mortgage loans.

Original article: [Chinese]

Tsingdao Brewery Prepares to Further Expansion Abroad

Company, page 26

~ Tsingdao Brewery net profits grew by somewhere between 75% and 85% in 2009. That means, adding the 1.2 billion raised through the issue of warrants, Tsingdao Brewery has raised over five billion yuan, providing the company with the resources to further its expansion abroad.

~ After purchasing Yantai Beer and Baotuquan Beer, the company has strengthened its position in the Shandong beer market.

~ Another factor that will be beneficial to its international strategy is that Tang Jun, CEO of the Xinhuadu Group that has bought a 7% stake in the brewer off Budweiser, has joined its board of directors.

~ With experience in handling international mergers, Tang has advised the company to go abroad and purchase assets instead of setting up factories by itself.

Original Article: [Chinese]

Where is Geely Getting the Funds to Finance its Purchase of Volvo?

Automobile, page 34

~ People close to the matter revealed Geely Automobile, a privately-owned Chinese automaker, would finish its financing for acquisition of Volvo before March 15 at the latest and would sign the final contract before the end of March.

~ A consortium led by both the London and Zhejiang branch of Bank of China has promised to offer five-year loans worth some 1 billion US dollars to Geely.

~ Geely Wanyuan International Investment Company, a new entity established by Geely Automotive last December, signed contracts to borrow money from the Export-Import Bank of China and Bank of China. ~ The company's registered capital now stood at between 8 billion and 9 billion yuan.

~ Guaranteed by Swedish government, many European banks also expressed a willingness to extend low-interest loans to Geely.

~ Geely Automobile's Hong Kong-listed firm signed a contract with Goldman Sachs Capital Partners (GSCP) last September, in which GSCP agreed to subscribe for convertible bonds and warrants issued by the firm. The deal could contribute 2.586 billion Hong Kong dollars (some 330 million US dollars) of financing funds for the automaker.

Original Article: [Chinese]

The views posted here belong to the commentor, and are not representative of the Economic Observer |