Issue Wrap No. 446, November 30

Highlights from the EO print edition, issue no. 446, November 30, 2009

Confessions of a Chinese Home Buyer

Cover

~ In this week's cover story, EO reporter Liu Weixun recounts his experience in hunting for a house in Beijing. Liu recently sold his house located by Beijing's east fifth ring road that he had bought six years ago.

~ The reporter planned to take a loan in order to buy a smaller place somewhere between north second ring road and fourth ring road of Beijing.

~ In the middle of October, he had reached a verbal contract with a house owner to buy a three-room apartment for 1.43 million yuan. However, two days later, the owner telephoned him to say that the house had been sold to others. Later on, Liu heard that the house had sold for 1.445 million yuan, only 15,000 yuan higher than his offer.

~ Over the following three months, Liu looked at nearly 30 apartments, whose size and location were suitable. However, most of these apartments were snapped up as soon as they came on to the market.

~ The report ends with the author explaining that although he spends all his non-working hours looking for a house, he hasn't been able to buy one that meets his requirements.

Original Article: [Chinese]

State Administration of Foreign Exchange Recruit Staff from Abroad

Cover

~ With the increasing likelihood of China's dollar-dominated assets depreciating, the State Administration of Foreign Exchange (SAFE) is being tasked with adjusting its currency and other asset holdings so as to maintain and increase the value of China's huge foreign exchange reserves.

~ To cope with this new challenge, SAFE had begun to recruit staff from abroad with experience in investing in overseas assets. The new staff will work in both its Beijing headquarters and offices abroad.

~ The SAFE has outlined its future priority as optimizing the asset allocation of foreign reserves by taking advantage of the dynamic equilibrium among different currencies and assets, and avoiding investing in high-risk products.

Original Article: [Chinese]

Price of Natural Gas to Increase Soon

News, page 3

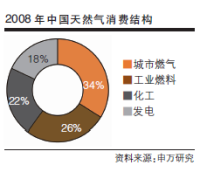

~ The EO learned that the country's natural gas price reform will not be carried out in one step. The price of gas for industrial consumption will first be adjusted and only after that will residential natural gas prices be adjusted.

~ A source close to the National Development and Reform Commission, the country's top economic planner, revealed that the formal adjustment would be carried out during the Chinese Spring Festival period at the latest.

Original Article: [Chinese]

A New Global Battlefield Over Carbon Emissions

News, Page 3

~ In the wake of both America and China announcing their carbon emission targets last week, attention has now turned to the thorny issue of MRV.

~ As part of the Bali Action Plan, in return for a pledge that developed countries will provide technology and capital to developing countries in order to help them tackle climate change, developed countries have agreed to ensure that their carbon-emissions are measurable, reportable and verifiable (MRV).

~ The issue of MRV is likely to be one of the most hotly debated topics at the upcoming United Nations Climate Change Conference in Copenhagen.

Original Article: [Chinese]

Changes to Income Tax Targeted at High Earners at SOE

News, page 4

~ China's Ministry of Finance (MOF) recently issued a notice, that defined additional bonuses like transportation payments, communication subsidies and other benefits as part of an employee's monthly salary. In the future, these extra payments, that were previously classed as "welfare" and therefore not subject to tax, will be taken into account when determining an individuals taxable income.

~ On November 26, an official from the MOF told the EO that the policy's original purpose was to strengthen management of the high amount of welfare payments that were being awarded in various monopoly enterprises and by doing so, making the payment system more transparent.

~ However, the notice has sparked off wide public discussion. Many regular wage-earners are worried that the implementation of this policy will reduce their monthly take home pay.

Original Article: [Chinese]

Chinese Toy Makers Shift to the Domestic Market

Nation, page 12

~ Dongguan city, in China's southern Guandong province, has long been known as the country's toy manufacturing base. However, a large number of toy makers went bankrupt after overseas demand plummeted during the global financial crisis.

~ Dongguan-based companies have begun to reflect on the current state of the industry. With some manufacturers who were highly dependent on original equipment manufacture (OEM) and added little in terms of value-added to their products, deciding that they might night need to invest in developing their own brands.

~ With that in mind, some toy makers in Dongguan have begun to shift their focus to the domestic market.

Original Article: [Chinese]

Restructuring China's Shoe Capital

Restructuring China's Shoe Capital

Nation, page 13

~ The economy of Jinjiang ,a city located in Fujian in Southeast China, is dominated by the shoe trade, but the city is facing a crisis of sorts as the increasing costs of material, labor and now are tightening credit market begin to bite.

~ "We grabbed market share from Wenzhou by offering lower prices, but now we're engaged in a tough price war," Hong Zhiqiang, the vice secretary of the enterprises commission in Jinjiang's Chenli County told EO.

Original Article: [Chinese]

New Lending Forecasts for 2010

Market, page 19

~ Chinese banking shares took a drop on November 24 on worries about a rumor saying the regulator would raise banks' capital adequacy ratio to 13 percent.

~ At present, Chinese banks were waiting for the regulator's directive for the next year's lending management, which would directly affect the bank's capital adequacy requirement.

~ "What the regulator worried about is whether commercial banks have adequate capital to deal with the possible bad debt risk in the future two or three years," a source close to China's central bank said.

~ A source from regulatory body revealed to the EO that the new lending for the next year would stand at between 7 trillion and 8 trillion yuan.

Original Article: [Chinese]

Roller Coaster Ride for Bulk Commodity Futures Market

Market, page 22

~ China's bulk commodities futures market has experienced huge fluctuations last week, thanks to the rapid retreat of hot money from China's securities market.

Original Article: [Chinese]

The views posted here belong to the commentor, and are not representative of the Economic Observer |

Related Stories

Popular

Briefs

- China's CPI Turns Positive as Trade Strengthens

- China's CPI returned to positive growth in November with food prices up 3.2 percent year-on-year in November.

- Source:National Bureau of Statistics

- Sneak Preview of Hu Shuli's New Caixin Project

- Signs of what Hu Shuli's next media project will look like emerged on her new Sun Yat-Sen University-hosted website on Monday.

- Source:Sun Yat-Sen University

- NATIONALISATION

- Advance of the State

- A look at the recent growth in the role of government and state-owned enterprises in a ran...