New Loans Continue to Fall in August

Market, page 17

issue No. 434, August 31, 2009

Translated by Liu Peng

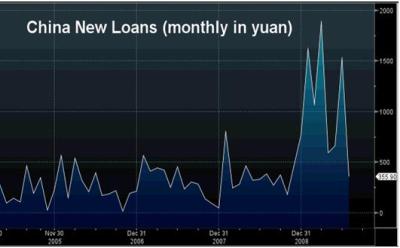

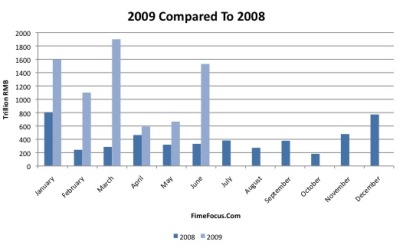

The amount of new loans issued in August may have fallen to less than 300 billion yuan (43.9 billion US dollars), as banks continued to ease the pace of their lending.

Lu Zhengwei, senior economist at China Industrial Bank, predicted that the amount of new loans issued in August eased to between 250 billion (36.6 billion US dollars) and 300 billion yuan.

If his projection is correct, it represents a further decline in new lending following the sharp drop registered in July, when new loans eased to 355.9 billion yuan (52.06 billion US dollars) from the 1.53 trillion yuan (223.8 billion US dollars) issued in June.

The Economic Observer learned that new loans issued by three of the four main state-owned banks (Industrial and Commercial Bank of China (ICBC), Bank of China and China Construction Bank) during the first 25 days of August amounted to less than 100 billion yuan.

In addition, some joint-stock commercial banks like China Minsheng Bank and China Citic Bank, whose "outstanding performance" during the huge growth in bank lending in the second quarter, have also eased their lending paces.

The EO learned that China's banking regulator began to strengthen supervision of the banks' capital requirements, which in turn put pressure on banks to reign in their lending.

In the past month, the Shanghai stock index tumbled 22% over concerns of a slow down in lending over the next 6 months.

Shi Chenyu, senior researcher at the ICBC's investment department, said "New loans issued in the second half of this year are likely to amount to 2.4 trillion yuan, which will push up the total amount of new loans issued over the whole year to 9.8 trillion yuan."

Links and Sources

Original Article: [Chinese]

Money and Markets: Graph

The views posted here belong to the commentor, and are not representative of the Economic Observer |

Related Stories

Popular

Briefs

- New Loans Continue to Fall in August

- The amount of new loans issued in August may have fallen to less than 300 billion yuan.

- Source:Economic Observer

- OPhones to Take on iPhone

- The 3G-enabled Lenovo Mobile OPhone is likely to provide stiff competition to Apple's iPhone in the China market.

- Source:China Mobile

- TAX

- Taxing Times

- China's tax bureau aims to collect an additional 100 billion in tax before the end of the ...