Pyramid Schemers Move On To Private Equity

News, Cover

~ “The company will refund all investments plus interest, if our assets haven’t been listed within three years,” promises Xuanyuan Private Equity Fund Co. Ltd (玄元股权投资基金管理有限公司), which was launched in July.

~The EO’s reporter last month went to hear one of the fund’s “money making” lectures in Shijiazhuang (石家庄), the capital of Hebei Province.

~The speaker, Xuanyuan’s marketing director, told the audience that the fund had listed two companies on NASDAQ, neither of which could be found by the EO.

~ One middle-aged woman at the lecture told the EO that she introduced some friends to this fund in the afternoon after listening to one of their classes in the morning. Most of Xuanyuan’s investors are between 35 and 45 years old from all across China, but many of them have little understanding of private equity.

~According to regulations from the National Development and Reform Commission, it’s illegal not to mention the risks when raising funds from investors. In order to raise funds, Xuanyuan depends entirely on investors introducing one another, which makes it more like a pyramid sales organization.

~Even so, there are no regulations on specific regulations on private equity funds in China, and the lack of official certification means that illegal fund raising and pyramid sales are a growing danger.

Original article: [Chinese]

Cash-starved Local Governments Seek Funds

News, page 3

~Local governments are taking steps to boost income by the end of 2011: tax bureaus in Nanjing (南京) and Yandu (盐都) in Jiangsu province have launched a “100 days”project for tax collection, while Guangdong plans to introduce a new levy on businesses enterprises, and Zhejiang province is busy preparing for provincial bonds.

~As the real estate sector weakens, the local government has seen a decline in its taxes and fees associated with the industry. Land transfer income has fallen sharply in Shanghai, Beijing and Guangzhou, while Zhejiang has also lost tax revenue from businesses whose owners “ran away.” ~Meanwhile, local governments have had to deal with rising expenses from large-scale investments and expenditure on education, medicine, public housing and agriculture.

~As a result, taxes are modified and supplemented. The resource tax will be reformed from Nov. 1, which will generate extra tax income of 60 billion yuan a year, while a surtax for education will raise another 500 billion yuan annually.

~However compared with local governments, central government’s financial position is relatively comfortable. Tax allocation reforms in 1994 guaranteed a stable share for central government, and with no sign of change to that arrangement, local governments have been forced to introduce their own measures.

Original article: [Chinese]

Railway Ministry Seeks To Blame Suppliers in Overdue Wenzhou Crash Probe

News, Page 4

~The State Council’s investigation panel last month said that preliminary findings blamed equipment defects and failure for the crash. It also said that safety management and the response to the technical failures was inadequate.

~There is no new timetable for the panel to announce its findings, which had been promised by Sept 15.

~People familiar with the investigation told the EO that the Ministry of Railways “doesn’t think it has a big problem with scheduling and transportation. The main reason for the accident was equipment defects.”

~Sources say that the investigation panel has communicated with the ministry more than 100 times, and disputes remain about the ministry’s responsibilities.

~ “The relevant people at Shanghai railway bureau and Wenzhou railway south station will be made to accept responsibility,” an inside source said, adding that the appropriate punishment is still being discussed.

Original article: [Chinese]

New Leaders for Stock Market Watchdog

Market, page 17

~With Shang Fulin(尚福林) approaching the end of his 10-year-term as chairman of China Securities Regulatory Commission (CSRC), personnel changes are underway at the stock market watchdog.

~Li Xiaoxue(李小雪), secretary of the discipline inspection commission will work in the listed companies association. He will be replaced by Li Xiaohong(黎晓宏), the deputy head of Beijing’s financial services office.

~ Information about the changes has spread online, but hasn’t yet been confirmed. Gui Minjie(桂敏杰) is also likely to be appointed as the president of Shanghai Stock Exchange., with Huang Hongyuan(黄红元) as his deputy

Original article: [Chinese]

Taobao Turmoil is Only Just Getting Started

http://www.eeo.com.cn/2011/1015/213528.shtml

Corporation, page 25

~ Taobao's relationship with its small and medium-sized online merchants is still tense.

~ Tao Ran (陶然), vice president of Taobao told the EO that Taobao Mall (www.tmall.com) will not make make any concessions and also won't alter their policy.

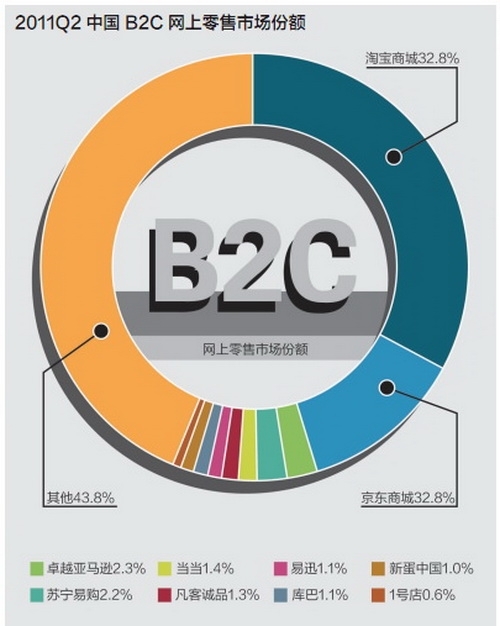

~ According to Zhang Yong (张勇) who is in charge of Taobao Mall, since separating off from Taobao.com this June, managers of Taobao's "Business to Consumers" (B2C) platform have been busy discussing the introduction of the new rules.

~ On Oct 10, Taobao Mall announced the final results of their deliberations: the annual fee for "technical services" in 2012 will be increased from the current 6,000 yuan to either 30,000 or 60,000 yuan a year. In addition, the deposits that merchants are required to put down will be increased from 10,000 yuan to either 50,000, 100,000 or 150,000 yuan.

~ After Taobao Mall announced the plan to increase fees, many online merchants began to protest against the changes. They attacked larger merchants using Taobao's platform by submitting repeat requests for refunds and leaving a lot of negative comments, halting the normal operation of Taobao's platform.

~ An employee with Taobao Mall's PR department explained that the deposits required of merchants will be kept frozen in an individualized Alipay account. After a merchant's contract expires, Taobao Mall will wait for three months until all after-sales services and disputes have been resolved, before returning the desposit to the merchant.

~ Taobao also says that many merchants will also have their annual "technical service" fee refunded if they meet certain requirements. Zhang said more than 70% of merchants will be able to have their annual fee refunded.

~ Taobao says it's hiking fees in order to force merchants providing lower-quality services to leave the online platform. The managers at Taobao consider Taobao.com as a free platform which allows consumers to deal directly with each other, thus providing opportunities for entrepreneurial individuals. However, they want to differentiate Taobao Mall from Taobao.com as a separate B2C platform.

~ Fake products and bad service quality will act like a "poison" on the new Taobao Mall. If Taobao Mall is unable to control these merchants, then Taobao Mall will, like Taobao.com, become a platform on which fake products are bought and sold.

~ Taobao Mall also plan to direct search traffic flow on their site to merchants who provide reliable service.

~ Taobao Mall needs to deal with the competition from its two domestic rivals buy.qq.com and 360buy.com, so it needs to ensure customers that merchants are reliable.

* On Mon afternoon (Oct 17), it was reported that Jack Ma (Ma Yun), chairman and CEO of Alibaba Group, had announced 5 measures aimed at winning the support of online merchants. The first condition was that Tmall would delay the implementation of the new policies for existing merchants until Sep 30, 2012. For new participants, the rules come into effect on Jan 1, 2012.

Original article: [Chinese]

Abrupt End to Wal-Mart’s Chongqing Honeymoon

Corporation, page 28

~Wal-Mart business in Chongqing is facing an unprecedented crisis after the company put organic labels on ordinary pork and sold it at a huge premium.

~Chongqing Administration for Industry and Commerce ordered the closure of Wal-Mart’s seven stores in Chongqing for 15 days and fined the company 2.7 million yuan.

~Since it launched in Chongqing in 2006, the U.S.-based retailer has been fined 21 times for selling food that was overdue, substandard or falsely advertised, with nine fines in 2011, the administration’s director, Huang Bo, said.

~Huang said the company continued to ignore the relevant regulations and had weak internal management.

~Tang Chuan the administration’s legal director told Xinhua News Agency that “every time when we spoke to Wal-Mart, they told us, ’our American headquarters require this approach, it will be hard to change.’ It’s like punching water.”

~“We required them to establish a record of supplies and sales, but they told us it wasn’t possible,” another Chongqing official complained.

~When Wal-Mart opened in Chongqing in 2006, the local administration embraced the retail giant, rushing through their application for a business license within a day, and Wal-Mark China sent people in 2009 to thank CAIC for their support..

~ Recently, CAIC called Wal-Mart, Metro, Carrefour and 15 other enterprises to a meeting at which the administration warned that once a problem is found in one store, all the other stores in the chain will be inspected.

Original article: [Chinese]

COMMENTARIES:

New Share Offerings Have Been Bad For Stock Index

By Huang Liming (黄利明), an EO Commentator

Nation, page 15

Original article: [Chinese]

China Central Huijin Investment Ltd spent about 200 million yuan buying shares in the four big state-owned banks on Oct 10, but this had limited impact on the market. A better way to boost stocks would be to slow down new equity offering and reduce transaction costs.

Why We Should Let Wenzhou’s SME Fail

By Qi Yue (启越), an EO Commentator

Nation, page 15

Original article: [Chinese]

Since the break out of Wenzhou private lending crisis, government has launched a series of measures to control the crisis. The author argues that the action of governments will give those imprudent investors a false impression: just do it and the government will take care of you.

The author thinks that Wenzhou’s private lending crisis is an opportunity to get private lending back on the right track, although it will be a painful process.

Make America’s Politicians Understand China Exchange Rate Policy

By Ouyang Xiaohong (欧阳晓红), EO reporter

Nation, page 15

Original article: [Chinese]

On Oct 11, the US Senate passed the Currency Exchange Rate Oversight Reform Act of 2011, which the author was a political decision rather than the action of serious law makers. He calls for China to respond with a reasoned explanation of its policy.

Taobao’s Monopoly Needs To Be Regulated

By Zou Weiguo(邹卫国), an EO Commentator

Nation, page 15

Original article: [Chinese]

Taobao’s decision to increase service fees is suspicion of a violation of anti-monopoly law; and the small online merchants ought to appeal to courts rather than taking to the streets.

“Loose Fiscal Policy, Tight Monetary Policy”

By Liu Yuhui (刘煜辉), Director of Key Lab of Finance, Chinese Academy of Social Sciences

Nation, page 16

Original article: [Chinese]

What is driving China’s inflation? What is creating China’s assets bubbles? How has usury become rampant in China? To answer those questions, the author argues that we need to go back to the government’s stimulus spending.

With its tight macro-policy, the government is seeking to control bank loans and inflation, but this can’t work without equivalent fiscal measures.

Sort Out China’s Oil Market

By Yu Sihe (余似禾), A senior analyst in Energy Market

Nation, page 16

Original article: [Chinese]

There are two causes for concern in China’s oil industry: the country is the world’s biggest energy consumer and its dependence on oil imports is greater than America’s.

The author argues that the thing which really threatens China’s energy security is lack of a developed oil trading system.