Issue Wrap No. 478, July 19

Highlights from the EO print edition, Issue Wrap No. 478, July 19

New Regulations for Listing on the Shanghai and Shenzhen Stock Exchanges

Cover

~ The Shanghai and Shenzhen stock exchanges have reached a preliminary agreement on how to deal with companies who apply to be listed on both of the two exchanges, the EO learned.

~ According to the agreement, non-financial companies whose planned stock issuance exceeds 80 million shares will only be allowed to be listed on the Shanghai stock exchange, while those whose planned issuance is below 50 million shares will go public on the Shenzhen stock exchange. Those who plan to issue between 50 million and 80 million shares can choose for themselves which exchange, Shanghai or Shenzhen, they wish to be listed on.

~ In terms of financial companies, if their IPO exceeds 400 million shares, they will only be permitted to be listed on the Shanghai stock exchange; if their listing is below 400 million shares, they will have to go public on the Shenzhen stock exchange.

~ The EO learned that currently, the agreement has only been circulated among high-level officials in the two stock exchanges and among the China Securities Regulatory Commission.

~ If everything goes well, the agreement will likely take effect in November this year.

Original article: [Chinese]

Export-oriented Firms Shift to Receive Domestic Orders

News, Page 6

~ In early July, the EO dispatched a reporter to coastal cities including Wenzhou to observe the status quo of export-oriented firms. Many export-oriented firms have taken a beating due to weakened global demand in the wake of the global financial crisis.

~ The EO found that in Wenzhou some export-oriented firms began to offer manufacturing services for domestic firms while receiving foreign orders at the same time.

~ Others are gradually quitting original equipment manufacturing in which profits are very thin and are focusing on creating their own brand of clothing and other products.

Original article: [Chinese]

Bi-annual Report Secret: Losses are Heading Downstream

News, Page 2

~ Although the Chinese economy had a growth rate of 11.1% in the first half of 2010 on the level of the same period last year, risks are imminent, according to China's Bi-annual Economic Report.

~ The China Leading Index released by the National Bureau of Statistics and the China Composite Leading Index of OECD (Organization of Economic Cooperation and Development) both peaked in September, 2009. The two are believed to be five and six months ahead of the actual economic situation, respectively. Which means, judging by the two indexes, the Chinese economy reached its peak in April and May and is beginning to fall.

~ Export orders began to decrease in May and June; prices of steel products, aluminium and zinc have decreased, indicating that downstream industries which manufacture products using these materials, including home appliances, industrial products and electronic products, are beginning to suffer losses.

Original article:[Chinese]

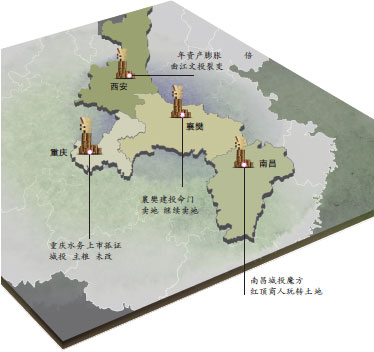

Local Financing Platform Roulette

Local Financing Platform Roulette

Nation, page 9-10

~ A large proportion of local financing platforms, which have been serving as the main financing channel of local governments, will be eliminated as the central government determines to take a tough position on regulating the risks of such platforms.

~ Each of the 3,800 local financing platforms nationwide are trying every method possible to avoid being reviewed or eliminated. Some experts forecast, local debts will reach 12 trillion yuan at the end of 2011.

~ The EO has learned that the China Banking Regulatory Commission (CBRC) and the Ministry of Finance are drafting a regulation to clearly define what constitutes a local financing platform as well as a public project because in the past loans were given to financing platforms in a package form and did not specify which projects they were for.

~ Most of the local financing companies believe that as the CBRC finishes unpacking the loans by determining whether there is a specific project for each loan, local financing platforms with sound profit-making abilities and development prospects will be allowed to continue to exist while others will be eliminated.

Original article: [Chinese]

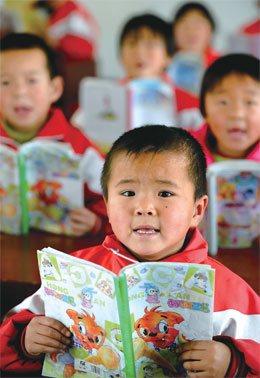

Everything is Free: China's Best Education Model

Nation, page 13

~ Wuqi, a small county in Shanxi Province, has provided free education for all of its students, from primary level to university level, since 2007. Students in Wuqi are not only exempt from paying tuition fees and housing fees, but are also covered by various subsidies and scholarships. This is the first time a Chinese county with medium-level financial capability has ensured equal education opportunities for every child.

~ "Based on rough estimates, the local government invests 4,000 yuan per student, per year," Zhang Junyin, headmaster of the Wuqi Senior High School, said. To attract excellent teachers, his high school, which is the only one located in Wuqi, provides a yearly salary of between 90,000 yuan and 150,000 yuan for the 20 elite teachers who come from other provinces. Additionally, these teachers have free housing and their spouses are offered various job opportunities in Wuqi.

Original article: [Chinese]

Sinosure found to Provide an Irregular Insurance Policy

Sinosure found to Provide an Irregular Insurance Policy

Market, page 17

~ China's Ministry of Finance (MoF) recently dispatched an inspection team to China Export & Credit Insurance Corporation (Sinosure) to audit its financial accounts, a move that will pave the way for Sinosure to receive an injection from the MoF.

~ The EO learned that the inspection discovered an irregular insurance policy provided by Sinosure.

~ In 2005, Sinosure provided insurance for a property project worth over 100 million yuan in Dalian, which has since only been half-completed and abandoned.

~ Because Sinosure is China's only policy-oriented insurance company specializing in export credit insurance, it should not provide insurance for domestic property developers.

Original article: [Chinese]

Agricultural Bank of China Manages to Go Public

Market, page 19

~ On July 15 this year, Agricultural Bank of China finally went public on the Shanghai stock exchange and one day later it became listed on the Hong Kong stock exchange.

~ The EO learned that it took over three months (119 days) for the Agricultural Bank to go public by calculating from the date that the bank unveiled its plan to be listed on April 5 to the date it finally went public on July 16.

~ The EO learned that strategic investors can buy over 30 percent of new shares issued by the bank.

Original article: [Chinese]

Chinese Steel Mill to Build Plant in US

Corporation, page 26

~ Tianjin Pipe (Group) Corporation (TPC) will invest 1 billion US dollars to build a pipe manufacturing plant in Corpus Christi, Texas nearby the Gulf of Mexico.

~ The project will likely begin construction in autumn this year and will be finished within three or four years.

~ The plant has a planned output of 500 thousand tons of steel pipes every year.

~ A senior manager at a centrally-owned steel producer said the reason for domestic firms to build plants in the US is very simple: Domestic steel makers are not subject to the anti-dumping duties imposed by the US government.

~ A source from TPC said, "Constructing a plant in the US enables us to get closer to the market and to reduce our transportation costs."

Original article: [Chinese]

Pioneers in Reducing Carbon Emissions: Best Low Carbon-emission Companies in 2010

page 57

This week the EO has done a special feature acknowledging Chinese companies with low carbon emissions. Some of the companies are: Build Your Dreams (BYD), Poly Xiexin Energy, AUX, Siemens, Mengniu Group, New World China Land, GTMC, JDP, Philips, Vanke, and Pingan Insurance

~As a world leader in the manufacturing of low-emission vehicles, BYD has reduced carbon emissions through continuously improving energy-saving technologies.

~Poly Xiexin Energy Holding Company has focused its business on China's solar power industry and has paid great attention to the cultivation of the solar power market in China.

~Mongolia Mengniu Dairy Group has emphasized environmental protection while pursuing economic efficiency.

~Philips has intensified its effort to promote energy-saving technologies.

~AUX(Ningbo) has tried its best to reduce pollutant emissions and energy consumption.

~New World China Land has been exploring energy-saving technologies and combining them with home design. It intends to bring a green lifestyle to people's everyday lives.

The views posted here belong to the commentor, and are not representative of the Economic Observer |

Interactive

Multimedia

- EEO.COM.CN The Economic Observer Online

- Bldg 7A, Xinghua Dongli, Dongcheng District

- Beijing 100013

- Phone: +86 (10) 6420 9024

- Copyright The Economic Observer Online 2001-2011